May 06, 2011

I had no intention of posting at all, but events keep dragging me back in. I want to at least keep somewhat of a record of the wealth portfolio performance, if for no other reason than to be able to blast a big fat fucking I TOLD YOU SO into the void at some point. So, I'd be remiss not to at least acknowledge this week's carnage in the commodities markets.

It's happened before and it will happen again -- commodities are extremely volatile. Since my call to rebalance on 4/27, silver is off over 25% while gold is down a mere 2% or so. My market timing is rarely that good, but silver was just crazy and $50 is a big number, so I don't think it was too hard a call.

This sell-off brings things closer to a much more sustainable annualized rate of return, especially vis-a-vis equity indicies. Even though silver is down a ton in a very short amount of time, it's too early to rebalance it back yet. There's a very good chance of more downside to come. A lot will depend on the equity markets and the relative USD performance, especially vs. hard commodity currencies (CAD / AUD).

In any event, since QE2 start, total performance of the wealth portfolio is 27.1% (vs. a peak of close to 40%). Total performance of the blended stock market is almost exactly 12%. It's nice to still be up this much after that solid a crushing. The effect of the debt ceiling 'debate' (really a foregone conclusion with a lot of associated theater) on everything will be interesting. As we're pressed up against the ceiling already, Congress had best get their sorry asses in gear.

Looking back to my post from 1/6 on what I thought might happen, point 6 is notable. We got to right around all those levels at the recent peak, well before I thought would happen. If the commodity space takes off again after the debt ceiling increase, look the fuck out.

Posted by: Hermit Dave at

04:33 PM

| Comments (1)

| Add Comment

Post contains 343 words, total size 2 kb.

April 27, 2011

Just to get it on record, I agree with this post by Mish. Although it could go much higher prior to a correction, Silver is looking shaky from a risk perspective at this level. It's just come too far too fast. So, for risk purposes, a portfolio that was 25% silver, 25% gold, 50% commodities (DBC), should readjust.

I recommend dropping silver to 10%, with 40% gold, 50% DBC. I also recommend maintaining a hedge via a stock index (I still prefer long dated options). Essentially, nothing has changed, so the basic portfolio concept is intact, but I think it's time to take some risk (and silver profits) off the table.

Oh, and Obama's 'birth certificate' is clearly bogus, not that it makes a damn bit of difference. As things stand, I prefer him to the GOP, as he'll drive things over the cliff faster. Given the stupidity of the electorate, we're going over the cliff either way and I'd just as soon get it over with.

Posted by: Hermit Dave at

02:56 PM

| No Comments

| Add Comment

Post contains 171 words, total size 1 kb.

January 06, 2011

Once again, I think there is an excellent speculative opportunity to short the market, with a favorable risk-reward profile. As before, the most likely result is a small loss, as this kind of a trade is fairly low percentage, but with a big fat tail (profit) when it works.

Short the Qs (ticker QQQQ) at 55.81 with a stop at 56.09 (approx. 0.5%).

Update (close of market): This is another one that needs to be closed out at a tiny loss as holding overnight without a good cushion increases the risk too much. As we get closer to the debt ceiling vote, I expect to try this kind of a trade repeatedly until it comes home (or I get carted out -- but with the kind of tiny losses I'm taking it will be ages before I can be carted out, which is why risk control is so important).

Posted by: Hermit Dave at

10:21 AM

| No Comments

| Add Comment

Post contains 152 words, total size 1 kb.

December 31, 2010

Pretty much everything with the exception of bonds ended on the highs for the year. Final 2010 results for the wealth fund vs. the investment fund:

| Asset | Start | Current | Change |

| Gold | 1348.59 | 1420.95 | 5.37% |

| Silver | 24.80 | 30.86 | 24.44% |

| DBC | 25.69 | 27.55 | 7.24% |

| Dow | 11215.13 | 11577.51 | 3.23% |

| Nasdaq | 2540.27 | 2652.87 | 4.43% |

| S&P500 | 1197.96 | 1257.64 | 4.98% |

| Wealth Fund | $12,000 | $13,328.44 | 11.07% |

| Investment Fund | $12,000 | $12,505.82 | 4.22% |

Year-end marks will have distorted the above figures somewhat, but at this time, the wealth fund is up almost 7% over the investment fund. That is a huge difference for two months worth of trading. The outright move of just over 11% is a bit on the insane side, as that projects out to nearly 70% annualized. If one goes back to when QE2 started to get priced into the market at the beginning of September, the numbers are even more insane. In short, this kind of trend is likely to be unsustainable, at least at this velocity.

This would be an excellent time to buy some downside protection on one's assets, if one hasn't already. I like the June 1100 S&P 500 puts for protection, which cost around 2.5% of notional assets for 5.5 months of 'insurance'. That being said, if the Fed keeps destroying the dollar, this trend could continue, even at this (or much greater, in the event of a currency crisis) velocity. That's why I prefer puts as a hedge as opposed to futures, and also why I don't want to be in cash.

Anyway, hope everyone enjoys their $3+ / gallon (and rapidly increasing) gas in the coming year. Keep focusing on gays in the military and the size of Brett Favre's peen, as that seems to be the most effective way to deal with the serious issues facing our country (eye-roll). For the new year, I'll be giving the new Congress about one month to get serious (which they won't), then I'll be writing off politics (and the political blogosphere) for good and playing 'every man for himself'. Good luck to all, because we're sure as shit going to need all the luck we can get.

Posted by: Hermit Dave at

02:01 PM

| No Comments

| Add Comment

Post contains 359 words, total size 4 kb.

December 17, 2010

The stock market has become such a farce that the NYSE should just put a banner on the building: "Sponsored by the U.S. Government". Effectively, the government is issuing debt to buy equities, through the QE2 mechanism, in an attempt to paint the picture that pension funds are solvent. To call the current situation fucked up would be an understatement.

I'm going to switch to a month-end posting of the fund battle results as the weekly thing is a pain in the ass, nobody reads this blog anyway, and monthly is enough for a long-term position. For those who might care (namely me), the wealth fund is still up about 3% over the investment fund, even with all the year-end book-marking and daily precious metal raids. I wouldn't be at all surprised to see this continue to narrow as we approach month-end. End-of-year prints are notoriously hilarious. Active traders will probably have a field day fading anything that's marked up too idiotically.

Posted by: Hermit Dave at

03:16 PM

| No Comments

| Add Comment

Post contains 166 words, total size 1 kb.

December 15, 2010

For a lot of reasons, the market looks extremely toppy here. I think this is an excellent low-risk point to get short (I'd use the Nasdaq), stopping out on a new local high. Entry: ~ 54.45 on the applicable ETF (QQQQ). Stop: 54.70 (only about 1/2%). Potential upside: looking for a move to about 50 (about 8%) in the short term. If it got there, I'd take some profits and leave a runner to target about 45 (where there'd be one hell of a lot of support).

Update (close of market): With this going enough in the right direction, it can be held (at least) overnight without much increase in initial risk. The Qs closed at 54.17, putting the trade up about 0.7%, and about 1% away from the inital stop, giving the trade a good buffer against opening gap risk.

Update 2 (next day close of market): Even though the Qs (miraculously) never hit the stop-loss, this trade would have to be closed out at a tiny loss at the end of business today. There is almost no overnight gap cushion left -- holding it would change the risk/reward profile dramatically. This is a perfect example of the type of profile I like to trade, if I'm trading on pure speculation. Small downside, big potential upside. If I'm right about the potential reward, I can bat less than 10% on this kind of trade and still end up a big net winner over time.

Posted by: Hermit Dave at

08:58 AM

| No Comments

| Add Comment

Post contains 248 words, total size 2 kb.

December 08, 2010

Bonds almost always lead stocks for the simple reason that it's a much, much bigger market and a hell of a lot harder to play games with. Stock traders are complete pikers compared to the bond boys. So, it's somewhat unsettling to see bond yields rise fairly dramatically since the start of QE2.Â

For example, the 10-year rate (arguably the most important point on the yield curve, as it's the most closely tied to mortgage rates, among other reasons) has increased almost 0.75%, going from about 2.5% to about 3.25%. The iShares Barclays 7-10 Year Treasury Fund (ticker IEF) is down almost exactly 5% since the start of QE2 (bond prices move inversely to yields). This is extremely bad news for housing prices and will eventually put heavy pressure on stocks.

There are other factors at play that might give us pause when it comes to asset prices. The Fed's current attempt to generate inflation might fail, or they might be forced to change their policies. Other nations could get completely sick of our approach to our predicament and start dumping assets wholesale (the Chinese have started tightening their monetary policy). Some EU nations could try to stop the insanity and start letting countries and banks go under (Germany is starting to make serious noises about being sick and tired of trying to bail everyone out). Hell, the EU itself could break up quite easily.

All this brings us back to the question of whether we should be in cash or holding a wealth preservation portfolio. This is a hell of a difficult choice to make, but could be crucial to our long-term fiscal health. Or can we have our cake and eat it too? To a certain extent we can, by hedging our wealth preservation portfolio by going short the US stock market.

The way to do this would be to either sell futures or buy puts on a major stock market index. The S&P 500 is probably the best index to use as a hedge. For futures, one would sell an amount that would insure the notional value of one's wealth preservation portfolio. Now, instead of just holding an outright position in risk assets, one would be effectively holding the spread between a wealth preservation portfolio and an investment portfolio. There's a lot less total risk in this position, but most likely less upside as well. It's also an expensive strategy to implement as one has to divide his funds evenly between the long and short positions.

A much less expensive strategy (in terms of up-front cash) to implement is to buy puts. A put is one of the two types of options (the other being the call), and gives one the right (but not the obligation) to sell an asset at a specific price at a future date. For example, one could own the March 2011 1050 puts on the S&P 500. This would allow one to sell the index at 1050 (about 15% below the current market level) at the option expiry date in March. This gives us protection against a major asset crash, while committing less than 10% of our total funds to doing so. Of course, this strategy comes with a different price: time decay. Even if the market goes nowhere, one would lose the premium paid to insure his portfolio. In the worst case (a completely flat market), this would cost us about 5-8% a year.

So, there are no completely free lunches -- hardly surprising.   The only way in which one gets burned by this type of hedging strategy is if we have a low-inflation economic recovery. In that case, an investment fund would outperform a wealth preservation fund, causing us to lose on both sides of our positions (obviously I think this is just a tad unlikely, to say the least). On the other hand, we could have a high-inflation economic collapse, giving us a win on both sides. Most likely, we'll capture some outperformance by hedging, while significantly reducing our risk. For those with significant assets to protect, insuring at least part of one's portfolio against an asset crash is, in my opinion, a very good idea.

Posted by: Hermit Dave at

05:21 PM

| No Comments

| Add Comment

Post contains 703 words, total size 4 kb.

December 06, 2010

How high is silver going? Well, based on the silver/gold ratio alone, one can make a case for silver at $80 - $100 per ounce. Also, as gold becomes increasingly unaffordable as jewelry for most people, a silver substitute would imply a continued rally.

I'm not much for price targets -- fundamental factors can change rapidly and Mr. Market will be the final determining factor in any event. I simply note that, even though silver seems to be quite high at this price, one can make a case for it going much, much higher.

Posted by: Hermit Dave at

12:41 PM

| No Comments

| Add Comment

Post contains 99 words, total size 1 kb.

December 03, 2010

The markets went from hanging by a thread on Tuesday to another huge reversal as the dollar stopped strengthening. Currencies are now trading completely backwards -- the tail is firmly wagging the dog. The Dollar rallied against the Euro as the situation in Europe further deteriorated, and then the ECB dramatically increased its pace of monetization. In a remotely normal world, this would have further killed the Euro, but instead it immediately caused the Dollar to start selling back off. Why? Because of increased pressure on the Fed to step up their pace of monetization. Bizarre, but that's the world in which we're living.

Current status of our fund battle:

| Asset | Start | Current | Change |

| Gold | 1348.59 | 1413.43 | 4.81% |

| Silver | 24.80 | 29.24 | 17.90% |

| DBC | 25.69 | 26.36 | 2.61% |

| Dow | 11215.13 | 11382.09 | 1.49% |

| Nasdaq | 2540.27 | 2591.46 | 2.02% |

| S&P 500 | 1197.96 | 1224.71 | 2.23% |

| Wealth Fund | $12,000 | $12,837.82 | 6.98% |

| Investment Fund | $12,000 | $12,229.47 | 1.91% |

The Wealth Fund completely took off vs. the Investment Fund and is now ahead by slightly over 5%. There's every reason to believe that this trend will continue as long as the governments of the world continue to monetize all the bad debt. Bank and Government debt will be defaulted on, one way or another. A hard default is unacceptable to most, so we're starting to get a soft default -- inflating the debt away. As I've stated many times previously, one does not want to be invested in the markets in this environment. They'll most likely go up, but at a pace well below the rate of inflation. I'll stick with a wealth preservation strategy, thank you.

No changes to the Ben Bernanke betting game, even though the recent data dump by the Fed indicates that Bernanke both made illegal trades and perjured himself in various testimonies. In a sane world, the man would already be swinging from a lamp post or at least wearing an orange jumpsuit -- in this world, nobody cares with the exception of a handful of financial bloggers. The Fed and the banks are holding the American people at fiscal gunpoint and nobody has the courage or political will do to anything about it. So be it.

Current odds for Bernanke's fate as of the end of next year:

- Strangled by Ron Paul -- 1000 to 1

- Hung for Treason -- 100 to 1

- Commits Suicide -- 75 to 1

- Killed by bankrupt lunatic -- 50 to 1

- Dead by other means / natural causes -- 35 to 1

- Fled the country -- 25 to 1

- Under indictment (or already jailed) -- 10 to 1

- Forced out of the Fed but free -- 3 to 2

- Still selling America down the river -- 3 to 2

Have a good weekend. Got silver?

Posted by: Hermit Dave at

02:56 PM

| No Comments

| Add Comment

Post contains 462 words, total size 5 kb.

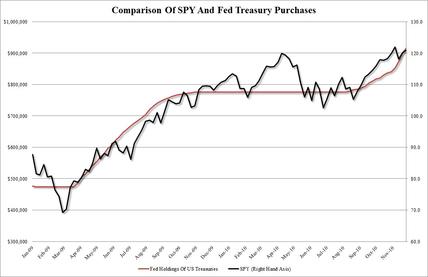

If you think that the stock market rally in the face of declining economic fundamentals seems a tad suspicious, you're not alone. Well, Zero Hedge has a single, simple graph that explains everything:

There's just a small correlation between Fed monetization and the rally in stocks, now isn't there?

Posted by: Hermit Dave at

10:46 AM

| No Comments

| Add Comment

Post contains 59 words, total size 1 kb.

November 30, 2010

The price action is incredibly interesting so far this week. Here are a few thoughts, including some follow-up on issues I've mentioned previously.

Bank of America: I had previously mentioned that BofA (ticker BAC) was effectively bankrupt and trading as such, except with an idiotically high stock price. Although my short-term timing is often hilariously bad, in this case the stock has gone straight down over 10% from almost the moment I wrote about it. There has also been speculation that the upcoming Wikileaks release of bank information will be from BofA. Whether or not that turns out to be the case, this stock is still a great short if one can take a lot of volatility. Anyone who owns this (or any other commercial bank) stock is a fucking moron.

General Motors: My opinion that GM (ticker GM) was a good medium-term buy on the open of the first day of trading hasn't proven to be terribly impressive so far. The offering has suffered from a fair amount of indigestion as many who managed to get in on the IPO seem to have taken a quick profit in the stock. On the other hand, my cynicism seems to have been well founded as the stock has yet to trade down through its IPO price of 33 and is now rallying back, even in the face of a declining market. My short-term timing of purchasing on the public trading open was admittedly crap, but my opinion that this is a good medium-term buy is starting to look better. The jury is still out on this one.

Consumer Stocks: If there is one thing propping up this market, it's consumer stocks. The best measure of this is SPDR S&P Retail ETF (ticker XRT). With the economy getting worse again and the consumer increasingly strapped, to say that this is hard to believe is quite the understatement. However, as the old saying goes, "The market can remain irrational longer than you can remain solvent", so I wouldn't be looking to fade this yet. This sector has upward momentum and a life of its own, similar to tech stocks back in 1999/2000. At some point, it will all end in tears, but I'd need to see some serious proof of an end to the momentum before shorting this sector.

Oil: Oil is whipping around as much as two percent a day. This is a crazy amount of volatility for the biggest consumable commodity market in the world. At the same time, the net movement in Oil is very small. It's been trading around $83 to $85 a barrel for quite a while now. This kind of volatility with little net price movement is indicative of something that's trying to digest two strongly competing factors before making its next big move. In the case of oil, the competing factors are quite clear: inflationary printing of fiat currencies vs. deflationary economic forces reducing demand. I have no strong opinion on the direction in which this will eventually resolve; however, I'm of the opinion that if oil breaks down, the stock market will collapse even more strongly (and largely for the same reasons).

Precious Metals: What can one say? In the face of increasing stock market weakness, gold and silver have taken off again. This is a clear indictment of global monetary policy. There are also serious supply/demand factors at play, especially in silver. It looks like some very large players may be standing for December delivery at the COMEX (the primary US metals exchange), which has the potential to cause a short squeeze of epic proportions. If you're not reading the precious metals commentary at Along the Watchtower, you're missing out, as the author has been so perfect in his market calls it's spooky.

The stock market is hanging by a fraying thread. The only thing holding it up at all is Fed monetization and some vague hopes about holiday sales. If it collapses, the question becomes whether other risk assets will collapse along with it. This goes back to the question of whether a 'wealth preservation' strategy or simply holding cash is the best option. With all western nations monetizing as quickly as they can get away with, I still believe wealth preservation will win out over the long run. In the short run, however, a sharp downward move in the stock market would likely lead to a similar move in commodities, especially oil.

Posted by: Hermit Dave at

02:10 PM

| No Comments

| Add Comment

Post contains 743 words, total size 5 kb.

November 26, 2010

Even with the holiday week (including today's half session), there was some interesting movement in the markets. The US Dollar was much stronger, due to the insolvency issues in Europe, yet commodities were still very firm. This is rather ominous for inflation.

The stock market still feels like it's poised for a sharp drop, but the Fed will be injecting approx. 35 billion dollars of monetization in the coming week. The problem is that, with so many holes in the global capital structure, even 35 billion may not go nearly far enough to keep propping up stocks.

The current state of our fund battle:

| Asset | Start | Current | Change |

| Gold | 1348.59 | 1363.15 | 1.08% |

| Silver | 24.80 | 26.66 | 7.50% |

| DBC | 25.69 | 25.26 | (1.67%) |

| Dow | 11215.13 | 11092.00 | (1.10%) |

| Nasdaq | 2540.27 | 2534.56 | (0.22%) |

| S&P 500 | 1197.96 | 1189.40 | (0.71%) |

| Wealth Fund | $12,000 | $12,157 | 1.31% |

| Investment Fund | $12,000 | $11,919 | (0.68%) |

The Wealth Fund is back up about 2% over the Investment Fund. Also, the spread between consumable commodities and precious metals has come in a fair bit. Both these movements are what we should expect over the longer term, although there is a chance that silver outperforms drastically, due to ongoing supply/demand issues. For those with limited wealth to preserve (or those who are willing to accept the increased risk of non-diversification), silver is likely to be the best place to keep it for a while.

No changes to the Bonehead Ben Bernanke betting game. See last week's post for odds. I hope everyone is having a good Thanksgiving holiday.

Posted by: Hermit Dave at

11:13 AM

| No Comments

| Add Comment

Post contains 256 words, total size 4 kb.

November 19, 2010

This week saw some strong early movement to the downside followed by consolidation and a pop into the GM IPO and options expiry. With the market pegged into the Friday close due to options expiry, and the GM IPO not acting terribly well, it feels like we might see some more downside volatility early next week. On the other hand, short holiday weeks are usually good for advances on light volume. So, for the short-term, flip a coin and hope for the best. Current results for our funds and their components:

| Asset | Start | Current | Change |

| Gold | 1348.59 | 1353.00 | 0.33% |

| Silver | 24.80 | 27.18 | 9.60% |

| DBC | 25.69 | 24.64 | (4.09%) |

| Dow | 11215.13 | 11203.55 | (0.10%) |

| Nasdaq | 2540.27 | 2518.12 | (0.87%) |

| S&P 500 | 1197.96 | 1199.73 | 0.15% |

| Wealth Fund | $12,000 | $12,052 | 0.44% |

| Investment Fund | $12,000 | $11.967 | (0.28%) |

Not a whole lot of net movement, obviously. The most interesting thing here is the increasing divergence between consumable commodities and precious metals. Oil and foodstuffs were sold heavily most of the week, while gold and silver sold off, then consolidated. While this kind of divergence can continue for a long time, it seems unlikely that DBC can continue to move lower without other risk assets selling off as well.

On to the Ben Bernanke betting game. What will be the fate of Bumbling Ben by the end of next year? Place your bets:

- Strangled by Ron Paul -- 1000 to 1

- Hung for Treason -- 100 to 1

- Commits Suicide -- 75 to 1

- Killed by bankrupt lunatic -- 50 to 1

- Dead by other means / natural causes -- 35 to 1

- Fled the country -- 25 to 1

- Under indictment (or already jailed) -- 10 to 1

- Forced out of the Fed but free -- 3 to 2

- Still selling America down the river -- 3 to 2

As the GOP is starting to make some real noise about the Fed, I've increased the odds that our favorite criminal is forced out and decreased the odds that he's still thieving away. I've also added a generic category for his demise because, well, hope springs eternal.

Have a good weekend.

Posted by: Hermit Dave at

12:42 PM

| No Comments

| Add Comment

Post contains 358 words, total size 4 kb.

Regular Zero Hedge commenter "Turd Ferguson" (if you don't know where that name comes from, well, too bad) has started his own blog. TF is a precious metals fanatic and very much into the semi-conspiracy theory of market manipulation in same.  I say semi-conspiracy because some of the manipulation is so well documented as to be proven, while some is a bit more 'out there'.  Unlike many gold bugs, however, TF is very smart and methodical in his analysis and worth reading.

His new blog is called Along the Watchtower, and I'm adding it to my blogroll. With the continued devaluation of global fiat currencies, and thus the increased prominence of gold and silver, it's worth keeping up with a blog that is dedicated to precious metals. I haven't included one before because, quite frankly, most gold bugs are batshit insane and have the writing skills of 8-year-olds on a sugar high. It's good to see someone who can address the subject in a rational and readable fashion.

Posted by: Hermit Dave at

09:33 AM

| No Comments

| Add Comment

Post contains 174 words, total size 1 kb.

November 17, 2010

The GM IPO is pricing today. Bloomberg Businessweek has a good summary of the deal. This is going to be a huge event, and will be very closely watched by everyone involved in the markets.

I think it's a no-brainer to buy the stock at the open of public trading tomorrow, almost regardless of price. There are just way too many powerful interests that need to see this offering go well, and for the stock to perform well, at least for a while.

This would be a pure cynicism play, with no regard for the fundamentals. As I've noted previously, fundamentals are almost entirely meaningless in the current market environment. This will eventually change, but with an IPO that's this important, there is almost no way in hell that the stock price will drop for a while.

The broader market could do almost anything. I've seen markets rally strongly on a big, successful IPO, and I've seen markets sell off as a big IPO sucked the air (and money) out of everything else. But I think that, for the medium term, mindlessly buying GM is the correct thing to do.

Posted by: Hermit Dave at

11:47 AM

| Comments (1)

| Add Comment

Post contains 195 words, total size 1 kb.

November 16, 2010

In light of the continuing collapse in risk assets (although I'm sure this very post will cause the collapse to stop), I think it's instructive to look back to see where the last rally started. QE2 was proposed, and started getting priced into the markets, at the end of August. Here are the levels of the assets I'm using for the fund battle as of August 31, and their increases as of the date of the QE2 announcement:

| Asset | Aug. 31 | QE2 | Change |

| Gold | 1247.00 | 1348.59 | 8.15% |

| Silver | 18.90 | 24.80 | 31.22% |

| DBC | 22.20 | 25.69 | 15.72% |

| Dow | 10014.72 | 11215.13 | 11.99% |

| Nasdaq | 2114.03 | 2540.27 | 20.16% |

| S&P 500 | 1049.33 | 1197.96 | 14.16% |

| Wealth Fund | $12,000 | $14124 | 17.70% |

| Investment Fund | $12,000 | $13853 | 15.44% |

If the entire recent rise in risk assets was speculative, these are the levels to which we should fall back. Given that the Fed was still doing QE1.5 during this period, and is now on QE2, I would expect to stay above these levels, all other things being equal.

Of course, all other things are not equal, and we've seen continued economic deterioration since the end of August. Also, Europe is having major issues, with their attempts to paper over the problems in Greece, Ireland, and elsewhere beginning to fail. The inflation vs. deflation battle is still raging on, more strongly than ever.

Unless and until the Fed is forced to stop monetizing the debt, I'm going to stay in the inflation (wealth preservation) camp. Note that under none of (what I believe to be) the possible scenarios would I be in the investment camp. To me, the choices are between cash and wealth preservation. At the moment, cash is winning out, as all risk assets are declining back towards the August launch point. It remains to be seen how much of the rise since then was speculative, and how much (if any) was actual inflation.

Posted by: Hermit Dave at

10:06 AM

| Comments (6)

| Add Comment

Post contains 316 words, total size 4 kb.

November 12, 2010

It was a wild ride this week, especially in commodities. Everything peaked on Tuesday, and at one point the broad commodity complex was outperforming the stock market by about 5%. Then the exchanges started to raise trade margins, and speculators were forced to post cash, reduce, or close positions. The result was a whopping sell-off that kept going all the way through the close today.

As for QE, it looks like a case of buy the rumor, buy the news, and sell the living shit out of the actual event. QE cash injections (POMO) will be an ongoing thing for the foreseeable future, but if today is any indication, the Fed has been frontrun many times over. The second half of this week took a lot of froth and short-term speculation out of the markets. The start of next week will be very interesting, as it should be an indication of how much speculation on QE remains.

Results to date for our fund battle:

| Asset | Start | Current | Change |

| Gold | 1348.59 | 1368.00 | 1.44% |

| Silver | 24.80 | 26.06 | 5.08% |

| DBC | 25.69 | 25.26 | (1.67%) |

| Dow | 11215.13 | 11192.58 | (0.20%) |

| Nasdaq | 2540.27 | 2518.21 | (0.87%) |

| S&P 500 | 1197.96 | 1199.21 | 0.10% |

| Wealth Fund | $12,000 | $12,095 | 0.79% |

| Investment Fund | $12,000 | $11,961 | (0.32%) |

The wealth fund is still a bit ahead of the investment fund, but the difference is down to about one percent. In the short term (especially early next week), the relative performance is likely to be based on how much speculation remains to be shaken out of risk assets. In the longer term, I'm still a firm believer in wealth preservation over investment. That won't change until the Fed stops debasing the dollar.

No changes to the Bernanke betting game. See last week's post for the odds on the fate of Bernanke by the end of 2011.

Posted by: Hermit Dave at

01:48 PM

| No Comments

| Add Comment

Post contains 305 words, total size 4 kb.

November 11, 2010

Another major market bell-weather, Disney (ticker DIS), just reported terrible earnings, missing on both top (revenue) and bottom (profit) lines. While Cisco is an indicator of the health of the technological infrastructure segment of the market, Disney reflects the strength of discretionary consumer spending. The stock, while holding up much better than Cisco, is down significantly in after-market trading (at the moment -- the situation is highly volatile).

My commentary here is identical to my earlier commentary on Cisco. Stocks are a terrible investment. Stick with wealth-preservation strategies.

Posted by: Hermit Dave at

01:12 PM

| No Comments

| Add Comment

Post contains 92 words, total size 1 kb.

Cisco (ticker CSCO) came out with earnings last night, and the top line (revenue) was a disaster. The stock is absolutely crushed today -- down about 16% at the time of this post. Cisco is a bell-weather stock: as one of the largest economic infrastructure companies in the world, they are an excellent indication of the overall health of the markets.

Collapses in Cisco have presaged both recent major bear markets. If one had used Cisco as a market timer, one would have done quite well on exits prior to broader market collapses. That being said, this time around is likely to be different, with the Fed printing money through QE.

Cisco is telling us that the economy sucks and that the market is overpriced. This is no surprise to anyone paying the least bit of attention. However, the broader market is no longer trading on anything remotely resembling fundamentals. With the fed doing QE POMO (cash injection) operations starting (again) tomorrow, the market is likely to stabilize and start moving higher again.

So, should one buy stocks? Absolutely not. As I've noted repeatedly since the start of QE2, the stock market is a terrible place to put one's money. Cisco's results merely clarify the broader economic picture, and reinforce my view that an investment strategy will massively under-perform a wealth preservation strategy. Stick with gold, silver, and consumable commodities and let the Fed and the stock market jerk themselves off.

Posted by: Hermit Dave at

10:51 AM

| No Comments

| Add Comment

Post contains 245 words, total size 2 kb.

November 10, 2010

Bank of America (ticker BAC) is a fascinating stock at the moment. It's trading like a bankrupt penny stock, but it's priced around $12.50. There's huge volume and extremely violent price swings. On any rational basis, BofA is bankrupt, but it's being propped up by the Fed. At some point, it almost certainly has to go, but God only knows when that might be. If you have an extremely strong stomach for volatility it's a great short, but you have to be prepared to take the position up the ass for a while.

One way to try capture value in the market is to trade around the relative valuation of gold, silver, and DBC (the three components of my 'wealth-preservation fund'). If we're treating gold and silver as alternate currencies, and DBC as our inflation benchmark, we can expect that (in the long term) they should move roughly in tandem. In the short term, however, there can be a lot of price volatility. The idea would be to sell gold and/or silver if they get too far ahead (in percentage terms), and buy DBC with the proceeds. When the precious metal(s) came back into line, we'd deallocate from DBC back into gold and/or silver. This strategy would have worked very well during the recent silver ramp-job as it got way way ahead of both DBC and gold.

I love Mish's writing and he's a valuable source of information, but at some point he's going to be carted away to a rubber room screaming 'There is no inflation!' as gas hits $10/gallon. This is a perfect example of the difference between theoretical and practical economics. In Mish's theoretical monetary terms there may well be no inflation, but it certainly exists for the average person.

For real-world examples of practical economics, one can look to the earnings of producers of consumer goods, and expect to hear the term 'margin compression' a lot in the near future. Denninger is ahead of the game on this, with the earnings results of both Dean Foods and Campbell's. In short, their input costs are way up and they have no pricing power due to the dire circumstances of the average consumer. Result: stock goes into the toilet.

Posted by: Hermit Dave at

10:52 AM

| No Comments

| Add Comment

Post contains 374 words, total size 2 kb.

45 queries taking 0.0572 seconds, 126 records returned.

Powered by Minx 1.1.6c-pink.