January 06, 2011

I'm largely through talking about what I think should happen, as my opinions are different from those of the vast majority and I'm completely fed up with politics. Instead, I'm just going to discuss what I think is going to happen and how one can try to profit, or at least protect one's self, from events.

First, let's not kid ourselves -- the debt ceiling will be raised. The only question is by how much, and therefore how soon it will come up for yet another vote. Oh, there will be some hand wringing and political grandstanding, but there is no way in hell politicians are willing to accept the immediate consequences of a failure to raise the debt ceiling. The can will, once again, be kicked.

I think that the most likely course of events will be as follows:

- Conservative politicians do a lot of tough talking and bloggers write about how we need to get this situation under control.

- The stock market sells off sharply.

- Articles start appearing in the MSM about all the bad effects of failure to raise the debt ceiling -- pension fund insolvency, big jump in unemployment, etc. The rhetoric coming out of the administration (which Geithner has already started) increases to a fever pitch.

- Politicians, after a lot of closed-door meetings with Wall Street types, where Armageddon is (yet again) threatened, decide they don't have the stomach for a difficult course of action. Conservative bloggers write conciliatory pieces while trying to make it sound like they're not doing a complete 180.

- The debt ceiling is raised by about $1.5T, with some nominal budgetary concessions and a lot of stomach-churning grandstanding. Conservative bloggers whine a bit but console themselves that 'it was the best deal we could get.'

- Risk assets go 'yee-haw!' and rally back strongly. Gold heads for $1,500, silver for $50, and Oil for $120. Everyone immediately starts bitching about inflation.

- The whole farce is replayed again in about a year except under much more dire circumstances.

Needless to say, I'm already set up for this kind of series of events, with a hedged wealth-preservation portfolio. If all goes as predicted, the hedge can be lifted about two weeks prior to the actual vote on the debt ceiling. Still, one will need to pay very close attention to any deviation from the above, as even seemingly small details (such as what comprises the concessions to enable the increase) can impact a proper investment stance.

Posted by: Hermit Dave at

11:40 AM

| No Comments

| Add Comment

Post contains 417 words, total size 3 kb.

January 02, 2011

Making market predictions is a fools game. There are too many moving parts, all of which can change rapidly, especially in a highly-charged political environment. The smart observer / investor will, instead of trying to predict the course of the markets, evaluate probabilities and position appropriately, with a willingness to change one's overall thesis upon shifts in the financial landscape.

The starting theme for 2011 is one of a continuation of 2010, as the Fed is still doing QE. Avoidance of dollar-denominated financial instruments, with wealth preservation as a focus, is still proper positioning. The one thing to note is that all risk assets are well overdue for a correction, so I also believe that a hedge is warranted at this time. Because of the difficulty of timing, I think cash is a bad idea, as we could easily see a further run-up in assets prior to a correction.

Going forward, the new Congress will play a major role, especially as we approach the current ceiling on the national debt. This will be a major issue from the middle to the end of the first quarter, and could easily cause the long-awaited correction in risk asset pricing. Also, at that point, QE2 will be about half completed, and the markets will be wondering about the Fed's next move. Should a correction occur at this point, an investor is going to need to pay close attention, as possible policy paths would have widely divergent economic results. We could correct and have a strong bounce, keep going down, or even never correct at all depending on which moves are made by Congress and the Fed.

To be honest, looking past this critical period is mostly a waste of time, as there are so many variables in play and a large number of possible outcomes. Still, assuming we make it through relatively unscathed, that the policymakers largely preserve the status quo (with further economic can-kicking), the rest of the year is likely to return to a repeat of the 2nd half of 2010. This would set us up for a 2012 disaster as, with gas breaking at least $4 / gallon and food inflation starting to put a huge dent in the average wallet, the election year would likely turn into economic and political chaos. It probably will regardless, as there will be major economic pain somewhere -- a continued decline in housing prices, pension fund collapses, state and municipal defaults are all possibilities, especially if we don't go the inflationary route.

In short, I expect to see some first quarter fireworks, followed by a relatively tame rest of the year. I wouldn't be at all surprised to simply maintain a wealth preservation portfolio, hedged with puts, throughout 2011. 2012 is where I expect the major issues to finally come to a head (damn those Mayans). There are so many possible exogenous factors, however, that pretty much anything is possible.

Other areas to watch for are: a possible Yen crisis, if Japan finally runs out of the ability to increase their national debt through the looting of the savings of their own citizens; a possible Euro crisis, if Spain or Italy blow up, or if Ireland gets balls and tells the EU to fuck off; a China crisis, if inflation takes further hold there, forcing some combination of capital controls, price controls, interest rate hikes, and/or Yuan revaluation. Or, some global hot-spot (North Korea? Iran?) could blow up and we could have an expansion of global conflicts. There are more than enough potential plummeting black swans to keep everyone ducking for cover throughout the year, so even though I expect 2011 to be mostly calm before the storm, I'll do my best to be prepared for as many eventualities as possible.

Posted by: Hermit Dave at

02:40 PM

| No Comments

| Add Comment

Post contains 631 words, total size 4 kb.

December 21, 2010

My sincerest congratulations go out to Banana Ben Bernanke, who as of today, has managed to surpass his first trillion dollars in US Treasury holdings! This makes the Fed easily the largest holder of US Treasuries in the world. Combined with their holdings in mortgage backed securities and other assorted garbage, the Fed has over $2.5 trillion on the balance sheet.

At his current pace, by this time next year, Ben will have managed to surpass $4 trillion. By then, gas should be well over $5/gallon and I'm sure the serial liar will still claim that there's no inflation and that he's not monetizing the national debt. Merry Christmas, ya fucking bastard.

Posted by: Hermit Dave at

12:02 PM

| No Comments

| Add Comment

Post contains 114 words, total size 1 kb.

December 09, 2010

If you want an excellent (if a bit hyperbolic) summary of what was revealed by the Fed's recent forced document dump, read this. Strong proof that, until the government deals with the Fed, your votes mean absolutely nothing.

(via Black Listed News)

Posted by: Hermit Dave at

12:25 PM

| No Comments

| Add Comment

Post contains 47 words, total size 1 kb.

December 08, 2010

Bonds almost always lead stocks for the simple reason that it's a much, much bigger market and a hell of a lot harder to play games with. Stock traders are complete pikers compared to the bond boys. So, it's somewhat unsettling to see bond yields rise fairly dramatically since the start of QE2.Â

For example, the 10-year rate (arguably the most important point on the yield curve, as it's the most closely tied to mortgage rates, among other reasons) has increased almost 0.75%, going from about 2.5% to about 3.25%. The iShares Barclays 7-10 Year Treasury Fund (ticker IEF) is down almost exactly 5% since the start of QE2 (bond prices move inversely to yields). This is extremely bad news for housing prices and will eventually put heavy pressure on stocks.

There are other factors at play that might give us pause when it comes to asset prices. The Fed's current attempt to generate inflation might fail, or they might be forced to change their policies. Other nations could get completely sick of our approach to our predicament and start dumping assets wholesale (the Chinese have started tightening their monetary policy). Some EU nations could try to stop the insanity and start letting countries and banks go under (Germany is starting to make serious noises about being sick and tired of trying to bail everyone out). Hell, the EU itself could break up quite easily.

All this brings us back to the question of whether we should be in cash or holding a wealth preservation portfolio. This is a hell of a difficult choice to make, but could be crucial to our long-term fiscal health. Or can we have our cake and eat it too? To a certain extent we can, by hedging our wealth preservation portfolio by going short the US stock market.

The way to do this would be to either sell futures or buy puts on a major stock market index. The S&P 500 is probably the best index to use as a hedge. For futures, one would sell an amount that would insure the notional value of one's wealth preservation portfolio. Now, instead of just holding an outright position in risk assets, one would be effectively holding the spread between a wealth preservation portfolio and an investment portfolio. There's a lot less total risk in this position, but most likely less upside as well. It's also an expensive strategy to implement as one has to divide his funds evenly between the long and short positions.

A much less expensive strategy (in terms of up-front cash) to implement is to buy puts. A put is one of the two types of options (the other being the call), and gives one the right (but not the obligation) to sell an asset at a specific price at a future date. For example, one could own the March 2011 1050 puts on the S&P 500. This would allow one to sell the index at 1050 (about 15% below the current market level) at the option expiry date in March. This gives us protection against a major asset crash, while committing less than 10% of our total funds to doing so. Of course, this strategy comes with a different price: time decay. Even if the market goes nowhere, one would lose the premium paid to insure his portfolio. In the worst case (a completely flat market), this would cost us about 5-8% a year.

So, there are no completely free lunches -- hardly surprising.   The only way in which one gets burned by this type of hedging strategy is if we have a low-inflation economic recovery. In that case, an investment fund would outperform a wealth preservation fund, causing us to lose on both sides of our positions (obviously I think this is just a tad unlikely, to say the least). On the other hand, we could have a high-inflation economic collapse, giving us a win on both sides. Most likely, we'll capture some outperformance by hedging, while significantly reducing our risk. For those with significant assets to protect, insuring at least part of one's portfolio against an asset crash is, in my opinion, a very good idea.

Posted by: Hermit Dave at

05:21 PM

| No Comments

| Add Comment

Post contains 703 words, total size 4 kb.

November 11, 2010

I've been intending to put up a post on silver for a while, discussing why it may be a much better alternate currency play than gold. However, it's a topic that requires a fair bit of detail -- combine that with my lazy nature and I hadn't got past a handful notes on the subject.

Fortunately for me, laziness sometimes pays off: There is an excellent post up at Slope of Hope which covers everything I had intended to say and more. I strongly suggest that anyone considering a wealth preservation strategy read it.

Posted by: Hermit Dave at

01:41 PM

| No Comments

| Add Comment

Post contains 98 words, total size 1 kb.

November 08, 2010

I've noted numerous times that, when the Fed and other central banks are debasing fiat currencies, the stock market is a terrible indicator of economic health. If one would like further proof of this, Zero Hedge has a post up showing the stock market valued in gold over the past three years. The chart they use is a much more accurate representation of the current state of the US economy than the stock market valued in dollars.

All standard metrics of economic health show a small bounce off the 2009 lows, followed by further slow deterioration. The S&P 500 as priced in gold reflects this extremely well. This concept, of course, is the basis for my current 'wealth preservation' vs. 'investment' fund battle. When fiat currencies are being debased as strongly and rapidly as they currently are, one simply can not use the raw (dollar denominated) stock market data as indicative of anything other than currency devaluation.

The Fed has made it clear that they are going to turn your dollar-denominated savings into trash, but the stock market is the wrong place to move those dollars. The ZH post, and associated graph, demonstrate this quite clearly.

Posted by: Hermit Dave at

10:57 AM

| Comments (1)

| Add Comment

Post contains 204 words, total size 1 kb.

November 03, 2010

So, the Fed announced today an additional $600 billion commitment to propping up the stock market so their cronies could cash out; er, I mean a commitment to bailing out the banks and paying executives huge bonuses at the expense of the average American; er, I mean a commitment to helping revive the economy. Yeah, that's it ... reviving the economy.

I knew this was coming, yet I'm still completely sick to my fucking stomach over this. I don't have the energy to write a long diatribe about this utter fucking disaster, or even explain in depth what it means. The economic, financial, and market links in my blogroll will simply have to suffice for analysis. The key point is that the Fed has committed to a pace of monetization that equals the projected debt of the Federal Government for the foreseeable future.

This does diddly-squat to revive the economy -- just ask Japan. All it does is steal, through inflation, from responsible and productive people in order to prop up a completely broken capital structure and pay off powerful vested interests. In Al-Qaeda's wettest dreams they couldn't do one one-hundredth of the damage to America that the Fed is doing.

What can the average person do about it? In the medium term, protecting oneself from inflation is the most important thing. Cash is trash, and in an ever increasing fashion. Bernanke is attempting to force us to buy dollar-denominated risk assets, but that is the one thing we must not do. Stocks are out -- they'll probably go up, at least for a while, but eventually the economic damage from the current policies make them a terrible investment. Bonds are likewise out -- they're the equivalent of Russian Roulette at these levels, and the Fed is playing a rigged game.

This leaves us with commodities and foreign investments. One can buy silver and gold as alternative currencies to combat dollar devaluation. One can buy into commodity funds with various weightings in things like energy, foodstuffs, and basic metals to protect oneself from inflation. One can also buy foreign currencies (and invest in foreign assets), but this is extremely risky as other countries can try to competitively devalue their currencies to 'equalize things' with the US. Going the foreign investment route opens up a Pandora's box of complexity and requires constant vigilance. I don't recommend it.

For someone with a relatively small amount of wealth to preserve, the simplest and most effective thing is to convert all savings into silver, gold, and commodity funds. Keep enough cash on hand for day-to-day expenses and to pay bills, but otherwise convert it into something which at least has a chance of holding its value. The PowerShares DB Commodity Index Tracking Fund (ticker DBC)  is nicely weighted, with an emphasis on energy. Combining that with some precious metal holdings would be a way to try to preserve your wealth without adding a lot of complexity to your life.

In the long term there are two possible solutions to our dilemma. The first is the political solution -- to make huge cuts in government spending, end the Fed, take a hell of a lot of pain, but maintain society and our country. The second is to write off America as beyond redemption, detach oneself from the government as much as humanly possible, and prepare to be largely self-sufficient. I'd like for the former to happen, but the clock is ticking rapidly, so I'm preparing for the latter.

Posted by: Hermit Dave at

07:03 PM

| No Comments

| Add Comment

Post contains 585 words, total size 4 kb.

October 28, 2010

Bill Black is the best financial regulator in recent history, and a voice of sanity in regard to the current banking fiasco. He was instrumental in resolving the S&L crisis in the '80s and directly responsible for some of the perpetrators of that fraud going to jail. In a sane world, he would be a lauded figure in the financial industry and his opinions would be sought by the media and politicians. In the real world, he's been marginalized.

As opposed to the clowns teaching economics at Ivy League schools, Black teaches at the University of Missouri - Kansas City. Unlike the crooks that advise the President and run the Treasury and the Fed, he has no political influence. Instead of being sought out by MSM outlets on the very serious and very topical issue of financial fraud, he's writing at the fucking Huffington Post, of all places. And yes, as dirty as it makes me feel, that's actually a link to the Huffington Post -- it's Black's most recent article there.

While it would be easy to go on a long rant about the government and academia in regard to Black's status among the elite, it would make only a trivial and tired point. Honest people aren't welcome among politicians, bankers, the MSM, and top educators. Surprise, surprise, yadda yadda yadda.

To me, a much more important point is that Black's status is a clear indictment of the conservative alternate media. His work should be featured prominently by conservative blogs. He should be writing articles for National Review (no link, they fucking suck, I'd just as soon read Sullivan). To their credit, Reason has lots of references to Black, but they're hardly conservative, and Matt Welch is laughingly an Editor in Chief there. On balance, they're about as good a media outlet as the HuffPo.

Conservatives had best get their heads out of their asses and start taking the financial situation in this country seriously. While sucking each others cocks over the coming election landslide for the GOP might seem fun, conservatives are setting themselves up to be even more reviled in 2012 than the Dems are now. If conservatives want to hold power for more than 2 years, if they wish to actually help the USA rather than just play politics, they need to start paying attention to people like Bill Black.

Posted by: Hermit Dave at

10:25 AM

| No Comments

| Add Comment

Post contains 396 words, total size 3 kb.

October 27, 2010

It turns out that the Fed has been soliciting opinions on QE directly from the supposedly independent, private sector primary dealers. This Bloomberg article explains what's been going on behind the scenes.

This Zero Hedge piece explains why this is, quite clearly, treason. It also dovetails very nicely with the piece that I wrote earlier today on QE. Still think your vote in the upcoming election actually makes a damn bit of difference? Unless the new Congress gets serious about tackling the Fed/Banking oligarchy (and right away), your vote is meaningless.

The time for dicking around with social policy and other side issues is over. You can demand that your representatives get off their pork-filled asses and deal with the real problems or you can kiss the USA goodbye.

Posted by: Hermit Dave at

09:54 PM

| No Comments

| Add Comment

Post contains 137 words, total size 1 kb.

While most are focused on the elections next Tuesday, there is an even more important event on Wednesday. This is when the Fed will announce its policy in regard to further Quantitative Easing. It would be nice if the elections were the more important event -- they certainly should be -- but as almost nobody in the political space is even talking about Fed policies, it gives Bernanke free rein to continue down the ruinous path on which he has set the country.

What will the Fed do? To try to figure that out, one has to ask what Bernanke's goals are. His primary goals seem to be: (1) Save the current banking system, (2) Promote general inflation without causing a dollar crisis, and (3) Keep the stock market levitating. Now, I completely disagree that these should be his goals, but Bernanke is a fucking criminal and I'm not (at least as far as I'm willing to admit). A discussion of what his goals should be is a different topic -- this post is examining what he might do.

The problem Bernanke has is that he's largely cornered. If QE is too small, the banking system will collapse. They've already pulled every trick in the book to try to save the system. Interest rates are already at zero, the banks are already allowed to lie about their balance sheets, and the QE done to date is being overwhelmed by mortgage fraud. Bernanke has to print a good bit of money just to keep the banks swimming in place.

If QE is too large, the US Dollar will collapse. This will cause the continuation of the current commodity explosion (in dollars), along with all sorts of terrible international consequences (trade wars, etc.). These effects will put the last spike into the heart of the average American, as prices will explode while wages largely remain stagnant. In the worst case, we get hyperinflation (which is really a currency crisis) and society starts to unravel.

So, Bernanke's challenge is to find just the right amount of QE to keep things slowly chugging along without blowing it all up. The problem is, he can't really have any fucking idea whatsoever what that amount might be. Estimates by 'experts' range from $200 billion to $4 trillion -- a spread wide enough through which to sail the Death Star with room left over for a few dozen Borg Cubes. And, in the miraculous event that he gets it right? The reward is the Japanese experience -- years and years of economic malaise while the zombie banks and the public sector suck up every last available dollar from producers and savers.

Clearly, Bernanke needs to go, but that would require an electorate that is focused on what really ails us as a nation, rather than gay marriage and whether or not Christine O'Donnell is a witch. In the absence of the political will to tackle the truly serious issues, the Fed's announcement on Wednesday is a good bit more important than the election on Tuesday. Which brings us back to the question: What will Bernanke do?

Fuck if I know, but I'm stocking up on lube.

Posted by: Hermit Dave at

01:16 PM

| No Comments

| Add Comment

Post contains 537 words, total size 3 kb.

October 25, 2010

A lot has been written recently about the percentage of Americans that pay taxes to the Federal Government. These articles, however, are all nearly worthless, as they only examine direct taxation. The truth of the matter is that, even if the Federal income tax were completely abolished, it would do little, in and of itself, to change the size of government.

A government that has direct currency control has no need for any explicit taxation. The government can simply print enough money to pay for itself. The government effectively goes from a direct tax to an indirect one by taxing through deflation of the currency.  This course of action is, in fact, recommended by extreme monetarists.

While I think that this type of extreme monetarism is a terrible idea for a lot of reasons, one must be aware that it is, to a certain extent, actually occurring in today's world. While the US Government doesn't have direct currency control, as the Fed is 'independent' (cough, bullshit, cough), we have a lot of indirect taxation through Federal debt, which is subsidized by the Fed's balance sheet. In short, we have the worst of both worlds, as we have direct taxation and indirect taxation, both of which hit producers and savers the hardest.

If I were to try to examine the effects of extreme monetarism, it would take a very long (and terribly boring to most people) series of blog posts. The purpose of this post is to simply point out that the issue of direct taxation, and the percentage of society that pays direct taxes, is only part of the picture. I'll leave the consideration of the effects of indirect taxation as an exercise for the reader (all zero of you).

Posted by: Hermit Dave at

10:09 AM

| Comments (2)

| Add Comment

Post contains 291 words, total size 2 kb.

October 15, 2010

I just realized that I didn't include guns (or other weapons) anywhere in the previous post. This is a serious oversight, as gun valuation and gold valuation are linked in many ways, yet ultimately completely uncorrelated.

Gun valuation is extremely interesting. In a perfectly stable society, they're only worth whatever recreational value people might place on them. This is similar to gold: in a society with a stable fiat currency, gold only has industrial and ornamentation value.

In a more realistic society, guns have the additional value of self-defense. This won't increase the worth of guns much, as crime is relatively low and military needs are limited, but it adds some value. This added value is extremely important however, as when one needs a gun, one is likely to really really need a gun. Again, this is similar to gold, in that it's a form of insurance. Just as I believe one should always have some gold, one should also have some guns.

As we get further away from a stable society, however, guns become increasingly more important. The value of gold will spike into a fiat devaluation event, but at the far margin (the Mad Max / Zombie Apocalypse scenario) it becomes completely worthless. A gun, however, is at its highest value on the far margin.

The gold to gun valuation relationship is at a very odd point right now. Essentially, the current valuations are telling us that, while a fiat currency breakdown is increasingly likely, a major societal disruption is still highly unlikely. I think these events are much more correlated than the market is currently assuming. On a relative basis, guns are unbelievably inexpensive. Go buy one.

Addendum: Veeshir's comment made me think a bit more. The rise in gun prices may be slowing down if the market for them is becoming saturated. One can't use more than a few at a time. Therefore ammo is really the factor to consider when looking at the pricing of gold vs. weapons. As Veeshir notes, ammo prices have gone up a lot more than gun prices in the last few years. I don't know if the relationship is at a sensible level though, as it's hard to find historical data on ammo prices.

Posted by: Hermit Dave at

11:31 AM

| Comments (2)

| Add Comment

Post contains 378 words, total size 2 kb.

Gold is a subject of much contention in the financial world. Â There are the 'gold bugs' who worship the stuff; there are haters, who think it's nearly worthless; there are those who view it as just another commodity; and, of course, there are those who think we should go back to a 'gold standard' for the US Dollar. Â How should a rational person view gold?

First, contrary to much of what one hears as common wisdom, gold is not a good inflation hedge. Yes, it can act as an inflation hedge at times, but it is extremely unreliable in this regard. Real estate is a much better hedge against broad-based, moderate inflation.

What gold is best for, and the reason why it is soaring at this time, is as a potential alternative currency. With the Fed trashing the US Dollar on an ongoing basis, and with the market assuming that they will continue to do so in an ever-increasing fashion, one must look for a different store of value for one's savings.  While large-scale dollar devaluation is wonderful for eliminating old debts, it destroys the value of all capital that is denominated in US Dollars. Hence, producers and savers must look for a way to retain the value of their holdings.

There are many potential assets into which one can convert his increasingly-worthless dollars, but there are issues with most of them: illiquidity (real estate), spoilage (food), valuation difficulties (diamonds), potential devaluation (other fiat currencies), etc. What is needed is an alternative currency, something which can maintain its value and is at the same time easily tradable. Gold and other precious metals work very well in this regard.

To see why gold, as opposed to other assets, can be a successful currency, let's examine the characteristics of a currency. A currency must be:

-

Durable -- it must not degrade over time.

-

Non-consumable -- even if used for other purposes, it must be recoverable

-

Relatively rare -- it can't be something so common as to be worthless

-

Relatively common -- there must be enough of it to circulate

-

Difficult to produce -- it can't be something everyone can get or make in quantity

-

Easy to verify -- counterfeiting must be avoided

-

Easy to value -- it must be completely consistent and measurable

-

Agreed upon -- most people must be willing to accept it as a means of trade

Gold passes all these tests. So does silver. One doesn't hear about 'silver bugs' simply because silver is more common than gold, but it would make an excellent smaller-denomination currency.

If one looks at the history of gold pricing (especially the period since restrictions on valuation and private ownership were lifted in the 1970s), gold has risen when the value of the US Dollar was in doubt. When people had faith in the US Dollar as a store of value, gold drifted lower towards its base industrial and jewelry value. Today, gold is soaring as the value of the US Dollar (and other fiat currencies) is being questioned more strongly than ever.

What should today's saver / investor do about gold? That largely depends on how one believes the Fed will act. If one believes the Fed will continue to destroy the value of the dollar, one should buy gold and other good alternative stores of value. If one believes the the Fed will get its act together and stop the current insanity, it would be a terrible time to buy gold.

I believe that one should always have some gold, for the simple reason that a central bank (or treasury -- whatever government function controls the currency) can always decide to devalue a fiat currency. However, I also believe in diversification. To the extent one can afford them and/or has space to store them, one's 'portfolio' should include real estate, silver, hand tools, a generator, food, fuel, a high-quality water filter, whiskey, etc. Essentially, one should have things that hold value, are tradable, and/or are used to produce trade and survival goods.

Best of luck to all in these uncertain times.

Posted by: Hermit Dave at

09:25 AM

| Comments (2)

| Add Comment

Post contains 677 words, total size 5 kb.

September 30, 2010

It is 'common knowledge' that the consumer is 70% of the U.S. economy -- it's a figure that's used all the time in economic reporting.  Too bad it's utter nonsense.  The consumer may be 70% of the way we measure certain aspects of the economy, but it's a statistic that is so misleading as to be harmful.

As usual, I like to get back to basics, in order to cut through the bullshit that passes for economic analysis these days. So, let's consider things from simple principles (warning: there will be some basic math):

The first important concept is how 'the economy' is measured. Should one measure production, consumption, or some combination of the two?  On a global basis (and ignoring for the moment reinvestment and a few other items) all production is eventually consumed in some fashion. Thus, we could claim that the consumer is 100% of the global economy. It would make a lot more sense, however, to say that consumption is 100% of production.

Now, let's add a few other important items. It is impossible to be perfectly efficient in production, so there will always be some waste (food spoilage for example). Also, on the basis of a group that is smaller than the entire world, one can consume more than one produces by taking on external debt. The main catch with debt is the interest expense. So, we're now at: Consumption = Production + External Debt - Interest - Waste.

Finally, the primary way to grow an economy (on a per-capita basis, which is what matters) is through reinvestment of production. It's also a good idea to save some of our production for unforeseen events and retirement. This gets us to an equation that covers all the most important items: Consumption = Production + External Debt - Interest - Waste - Investment - Savings.

Now ask yourself, "What is the actual goal of an economy? What are we trying to maximize?" The answer, of course, is wealth. From the standpoint of our equation, wealth is measured by savings and investment. The more you are able to save and invest, the wealthier you will be. Increased consumption is a byproduct of a wealthy society, but not the cause of one. Let's rearrange the terms of our equation to reflect this:  Savings + Investment = Production + External Debt - Interest - Consumption - Waste.

Now we have a useful way of looking at things, and can see the reason for the title of this post. To put it bluntly, consumption decreases wealth, so we wish to minimize our consumption to the extent which is reasonable. Measuring our economic health through our consumption is completely idiotic. Economic measurements should focus on the term in that equation which increases our wealth, namely production.

One final (and important) note is that our equation indicates that debt increases wealth (to the extent that it's greater than current interest). This is an unfortunate artifact of a 'snapshot' measurement of the economy. The truth, of course, is that we are losing wealth through interest, while the debt will eventually need to be paid back, subtracting this amount from our wealth in a future 'snapshot'. The effect of debt over time is therefore negative  (a net zero on principal and a loss on interest). A more rigorous (and needlessly complex for this post) approach would indicate this, along with a better breakdown of 'savings and investment' (assets such as houses, for example), as well as a few other time-series type items (such as depreciation and earned interest).

Posted by: Hermit Dave at

01:59 PM

| No Comments

| Add Comment

Post contains 582 words, total size 4 kb.

September 22, 2010

Productivity gains are always touted as a good thing, and they are to the extent that they free up labor for other productive endeavors. However, as productivity increases to the point where very little labor is required to produce vast amounts, we run into the problem of 'useless population'. This, in my opinion, is one of the main reasons we find ourselves in our current economic situation. This is also a situation for which libertarianism has no good solution, which, even as a libertarian, I'm willing to acknowledge.

Let's take an extreme example: Consider a population with one need/want -- food. If we maximize productivity, we have robotic farms which can feed millions with a handful of human workers. This sounds wonderful, except that most of those millions have no way to earn a living, as their labor is completely redundant. So one of three things must happen: (1) Those people farm for themselves so that they can survive, (2) We accept a socialistic society so that the productivity of the farms is distributed evenly, or (3) We borrow so that the 'useless population' can purchase food in the hope that they'll eventually become productive.

In situation (1) above, we devolve back to a much less productive society, which seems to be a very silly thing to do. In situation (2), most people are getting a free ride on the back of those that actually produce, which hardly seems fair. Finally, in situation (3), we start off with the equivalent of situation (2) and end up with unsustainable debt (which eventually causes either huge inflation or a crash) such that we're right back to situation (1).

I think it's easy to see how this simple example applies to the much more complex economy of the real world. We're currently in a nightmare hash of situations (2) and (3), and rapidly headed for situation (1). Many don't realize how prevalent situation (3) is at this point, but if one looks at the percentage of GDP that is subsidized through government debt, it's a rather astonishing 12%. This is a topic Denninger (rightly) keeps harping on and the referenced post is just the latest of his many diatribes on the subject.

Given our complex economy, it can be difficult to discern just how few people are actually productive, but it's probably far fewer than most realize. Take tax accountancy for example. From the standpoint of actual wealth, this is a completely useless and unproductive profession -- the financial equivalent of filling in holes that have been dug by the government. The profession neither creates nor preserves wealth, and is effectively part of a socialistic society -- just one in which make-work jobs replace completely free handouts.

At the moment, the governments of the world are trying to cover up the issue of 'useless population' by papering over the problem with a needless increase in economic complexity (health care legislation, etc.), borrowing, and outright printing of currency. The former is obviously socialism, while the latter is unsustainable. Either we're going to have to accept socialism, allow the expansion of debt/currency until we have hyperinflation or a crash, or we're going to have to find a better solution.

Clearly, I'm in the camp of find a better solution, but it's far from obvious what this solution should be. For today, however, this post is long enough. The reader (all zero of you) will hopefully think about the issue -- in the near future, I'll post about some of our options and the direction in which I think we should head.

Posted by: Hermit Dave at

10:33 AM

| No Comments

| Add Comment

Post contains 601 words, total size 4 kb.

July 31, 2010

As complex as things are in the financial world, it helps to return to first principles from time to time. The key principle in economics is the notion of wealth.  That $20 in your pocket (or 62 cents and a broken rubber band for most morons) is a representation of wealth in an economy that's complex enough to require a medium of exchange, but it's not wealth in and of itself. It's a piece of very fancy paper. So, what is wealth and where does it come from?

All wealth originates from the exploitation of natural resources. Without food, clothing, shelter, and energy, your new iGadget isn't going to do you much good. From there, almost all remaining wealth is created from two areas: Increases in productivity, and services provided to improve living standards. Lastly, there is the preservation of wealth, as there isn't much point in gaining wealth if someone bigger and meaner than you can come along and just take your wealth away, or if your wealth-gaining efforts despoil the natural resources to an extent that future wealth can no longer be created.

It helps to imagine a small farming community, where everyone does everything for themselves. Pa Kettle grows food, Junior Kettle hunts game and Ma Kettle sews clothes from the pelts of animals Junior brings home to the house they built themselves. Suddenly Pa gets an amazing idea -- he'll use his mule to increase the amount of food he can grow and harvest. Now Pa can grow enough food to feed 5 families. This lets one of his neighbors grow cotton instead of food and supply better clothes to the Kettles in exchange for food. Meanwhile, the lousy, but very imaginative, farmer down the way can stop subsisting on his own farming and instead tell everyone else entertaining stories in exchange for food and clothing. Finally, the other two farmers beat their plowshares into swords to protect this small community from the hippie commune over the next hill. Thus a basic barter economy is born.

Fast forward to today and ask yourself: Why are we, as a society, wealthy? Who provides this wealth? If we do A instead of B will this wealth increase or decrease? The 'science' of economics is supposed to provide answers to these key questions within the context of a complex economy. Unfortunately, most of modern economics is consumed with esoterica that does nothing to address these very basic concepts.

For example, how should one view the Government within this basic economic framework? The standard libertarian answer is that the sole function of Government is to preserve wealth, thus Government should be limited to self-defense, dispute adjudication, and a few other very basic functions. A libertarian believes that, due to the selfish nature of mankind, the Government can only be a rent-seeker (a person or entity that derives its existence from a continuing claim on the wealth of others), thus Government should be as small as possible. Those who advocate socialism would claim (whether or not they realize it) that the Government can somehow be a primary provider of societal wealth (good luck trying to demonstrate that). A 'conservative libertarian' such as myself is willing to admit that, in a large enough society, the Government can actually contribute to wealth in a limited form (productivity increases from the interstate highway system being my favorite example), and would allow for a few additional Government functions.

The point of this piece is not to try to analyze the true state of current economic conditions through first principles -- that would take several books, not a blog post from a moron. The point is to get the reader (all zero of you) to think about economics from a more basic perspective, so that it is much harder for someone to 'baffle you with bullshit'. Also, in the event of partial societal collapse (not impossible given the current state of the world) to consider how one might provide wealth in a more basic economy, thus ensuring personal survival.

The next time you're faced with trying to evaluate a complex economic question, simply ask yourself 'Does this idea create or preserve wealth?' It's amazing how easy it can be to cut through huge swaths of bullshit with this very basic question.

Posted by: Hermit Dave at

02:51 PM

| No Comments

| Add Comment

Post contains 720 words, total size 4 kb.

May 13, 2009

I haven't been posting much over the last few weeks because, aside from slowly recovering from massive nicotine withdrawl, I've been too busy reading all the back history at FMyLife catching up on FEM (Finance, Economics, and Markets). I knew things were really bad, and have said for a while now that Paulson and Bernacke (and Geithner since the Administration change) are completely corrupt, and robbing us blind. Unfortunately, as cynical and pessimistic as I am, it's far worse than I had thought.

Now that I'm up to speed, and not completely delerious from lack of nicotine, I'll hopefully have some thoughts about what one can do financially going forward. In the meantime, please continue to educate yourself, and try to encourage others to do the same. The future of the USA depends on the average voter becoming much more informed on FEM and putting a halt to the partisan politics that is destroying the country.

While I'm organizing my thoughts, have a look at this post at Zero Hedge, and this one at The Market Ticker, for an indication of just how fucked up our government is. Then, watch this video at CSPAN of the most recent AIG hearings. Yes, I know it's almost four hours long. However, this kind of thing is so important, that you should try to make the time, even if it takes watching it in 30 minute stretches over the course of a week.

The choice is clear. We can either continue to look aside while the political/banking kleptocracy loots America until there's nothing left, or we can start taking action. Taking effective action requires knowledge. If you're not willing to turn off the fucking TV and educate yourself, then you're part of the problem, not the solution.

Posted by: Hermit Dave at

09:00 PM

| No Comments

| Add Comment

Post contains 298 words, total size 2 kb.

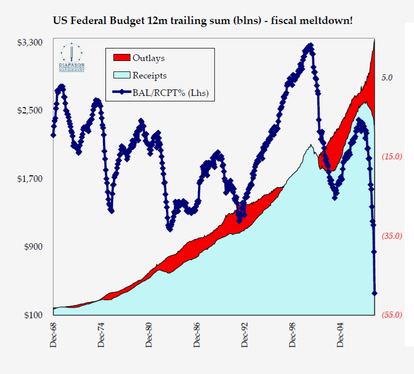

I think this chart speaks for itself, so I'll just be over here in the corner of my cave, whimpering like Obama without a teleprompter. (If you need some explanation, hit the link).

Posted by: Hermit Dave at

06:07 PM

| No Comments

| Add Comment

Post contains 42 words, total size 1 kb.

May 01, 2009

As a follow-up to the prior post, I have a simple question for those who are against allowing mortgage cram-downs during bankruptcy:

Do you approve of TARP, TALF, and the various other backstops that protect the bondholders of insolvent banks at the expense of the taxpayer?

I believe the standard conservative answer would be a resounding "Hell, no."

So, please stop and think for a minute, because these two positions are incompatible. Â We have a huge amount of excess debt in the system, debt that is worth far far less than par based on today's asset prices and ability to service that debt. Â This debt is going to be unwound, one way or another. Â And no matter which way we do it, it won't be pretty.

In my opinion, we must minimize moral hazard, and keep taxpayer expenses to a minimum. Â All the various government programs so far, uinder Paulson and continuing under Geithner, have backstopped the management and bondholders on Wall Street at the expense of the taxpayer. Â I think most conservatives would agree.

How is an opposition to mortgage cram-downs any different? Â Fine, you can force Joe Blow into foreclosure and he'll lose his house, if that makes you feel better. Â However, instead of bothering to file for bankruptcy, he'll just mail in the keys (which is his right under a non-recourse loan), leave no forwarding address and change his phone number to try to dodge the credit-card collection system, and work to rebuild his life from scratch.

Meanwhile, the bank now has the same overpriced asset on their books that they can't write down for fear of their own bankruptcy, and because they're still too big to fail, the next round of government support will simply take more money out of the taxpayer to keep the zombie bank running.

There are plenty of other long-term consequences from this course of action, but I think I've made my point. Â Put aside partisanship and emotion, think through the broader economic consequences, and realize that the source of an idea isn't what's important, it's the idea itself.

One final note: Â Never, ever, ever, ever, ever read the comments to an economic post on a political website. Â You'll be both much dumber and much more aggravated than you would otherwise be, if you had just thought the issue through yourself. Â I've known this for ages, but damn, that seems to be one of those lessons I have to relearn twice a year.

Posted by: Hermit Dave at

07:48 PM

| No Comments

| Add Comment

Post contains 417 words, total size 3 kb.

46 queries taking 0.0783 seconds, 123 records returned.

Powered by Minx 1.1.6c-pink.