April 30, 2009

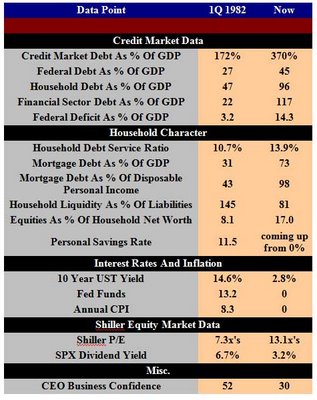

Via Zero Hedge again, here is a chart comparing the broad financial position of the US at the start of the huge bull run in 1982 vs. now:

Just point this chart out to anyone who tries to tell you that we're turning the corner, that the market has bottomed, etc. Â As the government has refused to take the hard road by forcing bankruptcies in order to get the excessive debt out of the system, we're in for a long hard slog (whether that be 1970s style or 1990s Japan style) at best. Â At worst, the bumbling by the administration and the Fed will severely exacerbate the problem, although it may kick the can down the road a bit.

We're in completely uncharted territory here, as the financial and government oligarchy are attempting to respike the punch bowl while the markets still have alchohol poisoning. Â The stock market is trying to get drunk again, but I don't think it will work. Â More likely, it will start projectile vomiting and end up in the hospital, getting its stomach pumped, followed by a long stint in rehab.

Posted by: Hermit Dave at

08:21 PM

| No Comments

| Add Comment

Post contains 190 words, total size 1 kb.

April 26, 2009

I know that posting something evenhanded and non-partisan on the state of the economy and markets isn't going to get me any friends. Good thing I don't give a shit.

So here's some excellent commentary on where we stand: Hussman's latest.

If one thing is clear from the last decade, it is that investors have no concern about the ultimate cost of the wreckage as long as they can keep a bubble going over the short run.

So sad, but so true. Â When I was working in Japan, after the burst of their bubble, the talk was about the 'hollowing out' of their economy. Â With our current federal/financial oligarchy directing capital to moribund institutions, rather than towards future productivity (or, ideally, just getting the hell out of the way), I expect to hear that phrase used for our economy as well.

Posted by: Hermit Dave at

09:20 PM

| No Comments

| Add Comment

Post contains 144 words, total size 1 kb.

April 25, 2009

Posted by: Hermit Dave at

05:30 PM

| No Comments

| Add Comment

Post contains 44 words, total size 1 kb.

April 17, 2009

One of the biggest issues I have with the political blogosphere is the placement of politics before economics. This is clearly putting the cart before the horse. It's nearly impossible for government, regardless of which party is in control, to make sound economic decisions. At best, the government can reverse prior bad economic decisions (this is the essence of most tax cuts).

In the long run, the importance of politcs pales before the importance of sound economic policy. Therefore, one's education should be in economics first, and politics second. Sadly, most people would prefer to play 'team sports' rather than switching teams (or deciding to look for a new team) based on rational economic decisions.

The Tea Parties are wonderful in this regard, but only so long as they remain essentially non-partisan. This doesn't mean that one party cannot respond to them better .. that would be fine. However, the movement should be ideologically (and economically) pure. The fact that pretty much all of the political establishment (from CNN reporters to GOP politicians) got their fair share of derision was very encouraging.

One of my current goals is to re-educate myself in the field of economics. This can not be done through conventional channels, unfortunately. From the idiotic boosterism of a clown like Cramer on CNBC to the various political arguments, one is constantly innundated with utter nonsense. One must scour the internet for independent voices.

The single best piece I came across today? This weekly analysis from an obscure fund manager. I'm not going to bother highlighting what I like about it. One should read, think, and decide for themselves.

Posted by: Hermit Dave at

08:30 PM

| No Comments

| Add Comment

Post contains 273 words, total size 2 kb.

April 15, 2009

... or how I learned to stop worrying and love recessions.

After noting The Market Ticker yesterday as a site that looked interesting, I've since read through a fair bit of the archives, and found that there is, indeed, tons of valuable material. If you're at all interested in economics, it's a site worth going through. I don't agree with everything there, and the writer can be a bit hyperbolic, but my thinking in a number of areas has been challenged, which is always a good thing.

One of my personal bugaboos has always been the 'end of the business cycle' crap. Putting off recessions, which we've been attempting to do for a long time now, is always a bad idea, and the more you try to do it, the worse the end result will be. This piece at The Market Ticker explains why recessions aren't only inevitable, they're an inherent part of the Reserve Banking system. People should be forced to read this piece (at gunpoint if needed) to get it through their thick skulls why playing politics with economics is not only a bad idea, it's futile (in the long run).

Posted by: Hermit Dave at

04:45 PM

| No Comments

| Add Comment

Post contains 196 words, total size 1 kb.

In my current addled state, I don't have the capability to write clearly and concisely enough to address just how truly fucked up the global financial situation is. It's easy for me to state what I find to be obvious, like AIG being an utter sham which is now being operated as a conduit through which to pass money to vested interests. Getting all my references for this statement together and putting out a coherent piece is the problem.

So, for now, I'll just point at an interesting and thoroughly depressing piece, titled America is Being Looted. Â The main quote:

The crash has laid bare many unpleasant truths about the United States. One of the most alarming, says a former chief economist of the International Monetary Fund, is that the finance industry has effectively captured our government—a state of affairs that more typically describes emerging markets, and is at the center of many emerging-market crises. If the IMF’s staff could speak freely about the U.S., it would tell us what it tells all countries in this situation: recovery will fail unless we break the financial oligarchy that is blocking essential reform. And if we are to prevent a true depression, we’re running out of time.

The author of the piece goes on to demonstrate just how true this statement is. Â It's not a fun read, but hard truths are needed more than ever these days.

Posted by: Hermit Dave at

03:50 PM

| No Comments

| Add Comment

Post contains 241 words, total size 2 kb.

April 14, 2009

As much of the blogosphere has stagnated, and almost everyone who tries to discuss economics or markets has no clue whatsoever, I'm always on the lookout for new sites (at least new to me).

The Market Ticker, after a bit of reading, reinforces a lot of my own views on economics, while at the same time challenging my thinking in regard to inflation and several other areas. It's a bit apocolyptic, but then again so are my opinions ... hell, I feel like I could have written a number of the posts myself. Er, that is if I were blogging when I was actually coherent and not from the depths of nicotine-deprived hell.

Anyway, it's a site to keep an eye on.

Posted by: Hermit Dave at

06:50 PM

| No Comments

| Add Comment

Post contains 127 words, total size 1 kb.

42 queries taking 0.0255 seconds, 89 records returned.

Powered by Minx 1.1.6c-pink.