November 09, 2010

My earlier post on Mr. Market calling Bernanke out on QE couldn't have been timed any better. I top-ticked today's spike in precious metals to almost the exact fucking minute. Now, the larger picture still holds, but damn, that was impressive short-term timing on my part.

I wonder if I can get a job producing the covers for Newsweek.

Posted by: Hermit Dave at

12:21 PM

| No Comments

| Add Comment

Post contains 60 words, total size 1 kb.

I thought it was relatively simple to foresee the long-term effects of the Fed's QE policy. Well, it turns out that Mr. Market has no intention of waiting for the long term. In the six short days since the announcement:

- Silver has gone vertical. It's now up over 16% and being aggressively bought on the tiniest pullback (more on silver coming in another post).

- Gold is up over 5%

- Broad-based consumable commodities are up around 5%, on average.

- Trade and currency wars are already starting: China is downgrading US Treasury Debt and starting to enforce capital controls. Other nations are telling us to go fuck ourselves in a variety of ways.

Zimbabwe Ben has completely screwed the pooch. At this point he's trapped. If he changes his mind on QE, both the stock and bond markets are likely to collapse. Banks will immediately start blowing up left and right. If he keeps going, other nations will move to protect themselves and then let the dollar go. The US gets severe inflation in the short to medium term, followed by a currency collapse.

The only sensible thing to do at this point is kick Bernanke to the curb, announce that QE will be continued in the short term, as needed and only for liquidity purposes, and start to wind down the big banks. This, of course, will cause other types of pain, but there is no way out at this point that won't be very painful.

The US is like one of the victims in the SAW movies. To save our lives we have to disfigure ourselves. Are we going to be able to do it?

Posted by: Hermit Dave at

09:56 AM

| No Comments

| Add Comment

Post contains 280 words, total size 2 kb.

November 05, 2010

Plus a new Ben Bernanke betting game!

Before we go any further, however, I haven't made a disclaimer in a while:

I am not a qualified investment advisor. I'm a moron posting stupid shit on the internet. Anyone who takes my thoughts and predictions seriously enough to use them to trade or invest is an even bigger moron than I am, and should be shot on the general principle of improving the human gene pool.

Here are the results for Week One (really only half a week, but this starts regular Friday results posting):

| Asset | Start | Current | Change |

| Gold | 1348.59 | 1397.75 | 3.27% |

| Silver | 24.80 | 26.70 | 7.66% |

| DBC | 25.69 | 26.41 | 2.80% |

| Dow | 11215.13 | 11444.08 | 2.04% |

| Nasdaq | 2540.27 | 2578.98 | 1.52% |

| S&P 500 | 1197.96 | 1225.85 | 2.33% |

| Wealth Fund | $12,000 | $12,496 | 4.14% |

| Investment Fund | $12,000 | $12,236 | 1.96% |

The Wealth Preservation Fund is off to an early, and statistically significant, lead over the Investment Fund. That being said, the horses have just left the gates, and it's a very long race. I expect this trend to continue in the long term, as the Fed can prop up the stock market by printing money, but only at the expense of even higher inflation. Still, this is a very volatile situation, and any given week could see large swings in any direction.

On to the Ben Bernanke betting game. This will be where we can bet on the fate of Ben Bernanke as of the end of next year (Dec 31, 2011). Here are the odds:

- Strangled by Ron Paul -- 1000 to 1

- Hung for treason -- 100 to 1

- Commits suicide -- 75 to 1

- Killed by bankrupt lunatic -- 50 to 1

- Fled the country -- 25 to 1

- Under indictment (or already jailed) -- 10 to 1

- Forced out of Fed but free -- 2 to 1

- Still selling America down the river -- Even money

If my spreadsheet is correct, that adds up to 100.64% -- close enough. Feeling cynical? Even money looks pretty good on him still going about his merry business of ruining America. Feeling lucky? Lots of good options at the top of the list. I'm going with the 10 to 1 shot that he's in an orange jumpsuit by the end of next year.

Fund results and Bernanke odds to be updated next Friday.

Posted by: Hermit Dave at

12:33 PM

| No Comments

| Add Comment

Post contains 394 words, total size 5 kb.

November 04, 2010

OK, not really, but I think it will be useful to measure, going forward, the effectiveness of a wealth preservation strategy vs. a dollar-denominated economic investment strategy. To that end, I'm going to track a number of key statistics.

In the wealth preservation corner, we have silver, gold, and consumable commodities (energy, foodstuffs, etc.) As a proxy for consumable commodities, we'll use the commodity fund I referenced yesterday, the PowerShares DB Commodity Index Tracking Fund (ticker DBC). Our 'wealth preservation fund' will be 25% gold, 25%, silver, and 50% DBC.

In the dollar-denominated economic investment strategy corner, we have the stock market. For this fund, we'll use a blended average of the Dow, Nasdaq, and S&P 500 indexes.

We're going to mark the funds to the close of business yesterday. As there was sufficient time to enter a position after the Fed announcement made it clear that they were going to go the full-retard debasement/inflation route, this makes sense. Because of the structure of the funds, it will be easiest to start with an amount that is divisible by both 3 and 4, so we'll give each of them $12,000 fake internet dollars.

Going forward, I'll post the performance of the funds and their components every Friday. This is much, much simpler than trying to manage an active portfolio and is a much better approximation of what the average person can do to try to preserve their wealth.

Ladies and gentlemen, place your bets. I'm going all-in on the wealth-preservation portfolio. Unless and until the Fed is forced to change their policies, I think this is a no-brainer. If, at some point in the future, the Fed is forced to stop driving the short bus over the cliff, we can revisit the issue of fund composition. Until then (and God only knows when that might be), there will be no changes.

We're at the starting line, and here are our marks:

| Asset | Start | Current | Change |

|

Gold |

1348.59 | ||

| Silver | 24.80 | ||

| DBC | 25.69 | ||

| Dow | 11215.13 | ||

| Nasdaq | 2540.27 | ||

| S&P 500 | 1197.96 | ||

| Wealth Fund | $12,000 | ||

| Investment Fund | $12,000 |

Posted by: Hermit Dave at

12:17 PM

| No Comments

| Add Comment

Post contains 353 words, total size 4 kb.

November 03, 2010

The model portfolio managed to survive today's QE announcement. It wasn't pretty, especially with the heavy reversal of the banks and the collapse in volatility, but it survived. However, this is just too much work to put into a blog that nobody reads.

The truth of the matter is that when you have a market that is trading at valuation extremes, based strictly upon the Fed debasing the currency, you have to be extremely proactive in portfolio management. This is one hell of a lot of work to do for no reward. If I really wanted to do this kind of work, I'd try to go back to Wall Street and make some money at it.

That being said, this was a good exercise for me. It got me back in touch with the markets and shifted my thinking from the realm of theory into the realm of practice. There is no good way to do this witout having something on the line, even if only fake internet dollars and the chance of looking like a complete fool. Final statistics:

| Asset | Start | Current | Change |

| Model Portfolio | $100,000 | $100,118 | 0.12% |

| S&P 500 | 1176.19 | 1197.96 | 1.85% |

| NASDAQ | 2468.77 | 2540,27 | 2.90% |

| Gold | $1,371.1 | $1348.59 | (1.64%) |

| Oil | $83.00 | $85.04 | 2.46% |

So, not terrible, but hardly impressive. Two and a half weeks is a blink of an eye in the bigger picture, but the early performance trend (vs. benchmarks) isn't encouraging. As the portfolio would need massive post-QE announcement changes and serious daily maintenance, and I'm not going to put in that kind of effort, it's best to just shut it down.

My biggest mistake was overhedging. During my trading days (in a previous life) I ran long-short books with little net exposure, but I also spent 80+ hours a week doing so and had the ability to react instantly when things started going against me in the markets. I also had the benefit (or curse, when losing money) of massive leverage. Running that kind of a portfolio is completely different than managing a wealth preservation portfolio and I simply didn't adjust my positioning enough.

So, what's a person with wealth to preserve to do? I'll have some thoughts on that when I post on today's Fed announcement. Short answer: silver, gold and oil, baby.

Posted by: Hermit Dave at

03:43 PM

| No Comments

| Add Comment

Post contains 383 words, total size 3 kb.

November 02, 2010

Let's imagine for a moment that Bernanke and his butt buddies on Wall Street are worried about a new Congress coming in and fucking up their plans to continue to rape and pillage the average American. What's the best way for them to maintain their oligarchy? Create a panic, of course.

The markets are setting up perfectly for this scenario. One with a sufficient amount of tin foil might say they've been set up this way. All Bernanke needs to do tomorrow is announce no further QE. At the same time, the Wall Street boys turn off the 'liquidity providing' HFT computers. The stock market goes kablooie, giving the appearance of a 'no confidence' reaction to the election by the markets.

This would put the incoming Congress in a very bad spot. They'd need to decide immediately whether or not to continue to sell out to the banking oligarchy. As most politicians aren't looking much past the election, and are mental midgets relative to the banking crooks, odds are that America would find itself sold further down the river even before the last vote was counted.

Tomorrow is going to be a very interesting day.

Posted by: Hermit Dave at

10:19 AM

| No Comments

| Add Comment

Post contains 198 words, total size 1 kb.

October 29, 2010

Another week of noise. Not terribly surprising going into next week's Fed announcement, but still pretty tedious. The only thing of any note was NASDAQ outperforming the S&P 500 by about 1% this week, continuing its long trend. I'm going to make one small portfolio adjustment going into next week:

- Close the long Google (GOOG) position at 613.7, for a gain of $48.29

Even though I'm closing this position, it has the effect of increasing my risk, as the Google position was partially offsetting my short NASDAQ position. On the other hand, it leaves me more balanced on the overall dollar devaluation issue (I had previously had a slight tilt towards further devaluation). With the puts on the S&P 500, if the market sells off, I'd be increasingly skewed to the downside, which is what I want.

Current positions:

Â

| Direction | Position | Value | Change |

| Long | Gold | $9,897.89 | (1.02%) |

| Long | S&P 500 | $15,090.16 | 0.60% |

| Short | Banks | $15,068.93 | 0.46% |

| Long | GS | $10,041.75 | 0.42% |

| Short | BAC | $5,047.58 | 0.95% |

| Long | Oil | $10,240.19 | 2.40% |

| Short | EUR/USD | $14,767.37 | (1.55%) |

| Short | NASDAQ | $9,710.87 | (2.89%) |

| Long | Puts* | $846.69 | (15.33%) |

| Long | Cash | $9,484.31 | N/A |

* Puts are on the S&P 500, dated March 2011, struck at 950

Results to date:

| Asset | Start | Current | Change |

| Model Portfolio | $100,000 | $100,196 | 0.20 % |

| S&P500 | 1176.19 | 1183.26 | 0.60 % |

| NASDAQ | 2468.77 | 2507.41 | 1.57 % |

| Gold | $1,371.10 | $1,357.10 | (1.02 %) |

| Oil | $83.00 | $81.43 | (1.89 %) |

Wow, how exciting. Next week should be much, much more interesting. Monday and Tuesday will likely be completely dead, followed by an absolute explosion of activity once the Fed announces its QE policy going forward. The elections may have some consequences down the road for the markets (hopefully they will, if the GOP gets off its ass and does something about all the fraud), but the Fed announcement completely dwarfs them in terms of importance.

My greatest concern going into next week is the NASDAQ outperformance. While my focus is long term, I still need to account for shorter term trends that move against my thesis. If, after the announcement on Wednesday, that position is still moving against me, I'll likely close it for now, reexamine that particular trade concept, and reestablish the trade later if I still think the concept is valid. In any event, portfolio adjustments and rebalancing seem to be a likely event towards the end of next week.

Posted by: Hermit Dave at

02:25 PM

| No Comments

| Add Comment

Post contains 396 words, total size 5 kb.

October 27, 2010

Today was just more noise, but I want to reposition my bank trades. To that extent, I'm going to close the following trades:

- Short Banks, closed at 45.70, for a gain of $143.38

- Long JPM, closed at 37.58, for a loss of $14.59Â

- Long GS, closed at 160.46, for a gain of $119.32

I had been long JP Morgan Chase in the thought that they were the most politically connected of the big commercial banks, but the truth of the fundamentals is that they're just as fucked as all the other commercial banks. Goldman Sachs is the one bank that's different, and as far as being politically connected, they are the government for all intents and purposes.

My new and reestablished positions:

- $15,000 Short Banks, as measured by the BKX index, marked at 45.70

- $5,000 Short Bank of America, ticker BAC, marked at 11.56

- $10,000 Long Goldman Sachs, ticker GS, marked at 160.46

This leaves me $20,000 short / $10,000 long as before, but with a risk profile I greatly prefer. BofA is easily in the worst position of the big commercial banks (financially and politically), and if there is to be a 'sacrificial lamb', they'll almost certainly be it. In the event of a wholesale change to the banking system, I'm still net short.

These changes put my cash balance at $4,436.02. Results for Week 2 on Friday.

Posted by: Hermit Dave at

11:47 AM

| No Comments

| Add Comment

Post contains 231 words, total size 2 kb.

October 25, 2010

I'm going to stop doing a daily Model Portfolio update, as nobody reads this drivel anyway most days are likely to be short-term noise with very little long-term significance. I'll update in the event of large-scale movement or if I make a change to the portfolio. Weekly results will also continue. Today was a noise kinda day, but generally good for the portfolio as banks got whacked even with the market up a bit.

If I have anything that I feel is worth saying in regard to the markets outside of portfolio performance, I'll do it in a separate post. As my focus is much longer term than that of most traders, however, it's not likely I'm going to have much to say on day-to-day market crapola.

Meanwhile, read Denninger for constant updates on the mortgage fiasco, read Zero Hedge for your daily dose of market cynicism, gold touting, and conspiracy theories, and most importantly, Move Your Money.

Posted by: Hermit Dave at

12:03 PM

| No Comments

| Add Comment

Post contains 165 words, total size 1 kb.

October 22, 2010

Today was one of those quiet, mildly annoying, short-covering days in the market. This is perfectly understandable going into the weekend, especially with the G20 song and dance revving up. As I think my portfolio is well-hedged for anything that might come out of the G20, I see no reason to take off risk (move into cash). So, no changes to the portfolio at this time, just results for week 1.

This week's results were largely meaningless, even with the whoop-de-do on Tuesday and Wednesday. Up a bit here, down a bit there, everything well within the parameters of short-term noise. As net movement was so small, I'm not going to bother posting position-by-position info, just total results for the portfolio and benchmark(s). One quick note: due to an error in the spreadsheet I made to track this shit, my closed position proft/loss was slightly off, so I'm taking an adjustment of -17.57 to my cash balance. The error had no effect on outstanding position PnL, and my cash balance is at $4,187.91.

Â

| Item | Start | Current | Change |

| Model Portfolio | $100,000 | $99,897 | (0.10%) |

| S&P 500 | 1176.19 | 1183.08 | 0.59% |

| NASDAQ | 2468.77 | 2479.39 | 0.43% |

| Gold | $1,371.10 | $1,327.7 | (3.17%) |

| Oil | $83.00 | $81.95 | (1.27%) |

So, stocks mildy up, hard assets down a bit, model portfolio almost dead flat. If my results remain this boring and pointless for more than a few weeks, I'm gonna shoot myself for all the time I'm spending on this nonsense.

Have a good and risk-free weekend!

Posted by: Hermit Dave at

11:56 AM

| No Comments

| Add Comment

Post contains 253 words, total size 2 kb.

October 21, 2010

Today was a big nothingburger, even with gold down a good bit. Some random thoughts:

At some point Netflix (NFLX) is going to be a monstrous short. Now, however, is not likely that time, as the current short interest is huge. While they're clearly a legitimate business, they've got stiff competition in the on-line delivery space, and they're priced way way above any rational estimates of earnings growth. One of these days, it's going to be 'look out below', but the stock could go much much higher before that occurs.

Gold looks like crap short-term. However, while it's tempting to dump the position in the model portfolio, it would be a terrible move. The model portfolio is for capital preservation, and trying to eliminate Fed risk. Gold is a core holding of that strategy, so if it goes down, it goes down. C'est la vie. Still, if I were running a speculative portfolio, I'd short the living shit out if it short-term.

The more I look at a long SPX, short NASDAQ position, the more I like it. I expect that to also be a core position of my model portfolio. The spread between the two has absolutely blown out in the last couple years. While technology is definitely the growth space, we're not growing. In fact, NASDAQ encompasses much more discretionary spending than does the broader SPX. I expect this spread to come in a lot over the coming years.

Tomorrow will be results day for Week 1 of the model portfolio. Unless we see some really large movement somewhere, it's looking like I could have just kept the full $100,000 fake internet dollars in cash and taken a nap this week. It would be pretty amusing if I finished the week completely flat.

Posted by: Hermit Dave at

12:14 PM

| No Comments

| Add Comment

Post contains 299 words, total size 2 kb.

October 20, 2010

One theory of trading says that the market will move in such as way as to hurt as many participants as possible. Â This is often referred to as the theory of maximum pain. Like most trading theories it works ... except when it doesn't. Â But it can be fun to try to figure out a market move that will hurt a lot of traders.

From my perusal of trading sites, it seems that almost all participants are making two dangerous assumptions: Â (1) Further QE is a given and it will keep the market levitating; and, (2) The market will not sell off prior to the election. Â Even many traders with a long-term bearish outlook are assuming this and are currently long.

It would be fun to make a 'maximum pain' trade and bet on a sharp move downward that occurs prior to the elections. Â Short-dated puts would be ideal for this, especially on gold. Â A large downward move in risk assets would likely take everything with it, but in the short term gold seems most vulnerable. Â It's due for a large correction and a big crack just before the elections would screw a lot of people.

Odds are, the two assumptions above are in fact correct, but they're still dangerous if one is not prepared for them to be wrong. Â I'm tempted to put on a small 'maximum pain' trade in my model portfolio, but short-term gambling is not the purpose of that particular exercise. Â If the market (especially gold) does tank prior to the election, the wailing and gnashing of teeth coming from various trading sites will be amusing as hell.

Posted by: Hermit Dave at

07:15 PM

| No Comments

| Add Comment

Post contains 274 words, total size 2 kb.

The market broadly reversed yesterday's price action, and my rebalanced portfolio behaved beautifully. The only thing I'm missing is some downside beta and asset crash protection. To that end, one new position:

- $1,000 Long Mar 2011 S&P 500 Puts, 950 Strike (marked at the CBOE bid/ask midpoint -- 14.35)

With today's rally and associated decline in volatility, it's a great day to be buying long-dated puts, so I'm going to take advantage of it. All other positions remain the same and I'm left with a $4,205.48 cash reserve, which should be enough to cover any short-term moves against my positions.

Bring it Bernanke! Let's see whatcha got, punk!

Posted by: Hermit Dave at

12:25 PM

| No Comments

| Add Comment

Post contains 113 words, total size 1 kb.

October 19, 2010

I picked a bad week to start sniffing glue. Things are all over the freaking map, thanks to the Fed dicking with dollar devaluation. Almost everything is trading strictly based on various views of whether and how much the Fed will continue to devalue the dollar. Fundamentals? Common sense? Bankrupt companies being forced to tell the truth about their balance sheet and actually go under? I wish.

One thing about my portfolio is clear -- it's way too concentrated in certain places, so I need to rebalance and diversify. To that end:

- Closing the short bank position at a mark of 46.03, a loss of $429.07

- Closing the NASDAQ short at a mark of 2,436.95, a gain of $195.86

- Closing the short EUR / long USD position at a mark of 1.3734, a gain of $438.69

This leaves me with my long gold and long S&P 500 positions, and a cash balance of $75,205.48. I don't want to have a zillion positions, but I need to spread the risk out a bit. New and re-established positions:

- $20,000 short banks (KBW bank index mark of 46.03)

- $5,000 long Goldman Sachs (Symbol GS, marked at 156.72)

- $5,000 long JP Morgan Chase (Symbol JPM, marked at 37.69)

- $10,000 long oil (Nymex front month mark of $79.52)

- $15,000 short EUR / long USD (mark of 1.3734)

- $10,000 short NASDAQ (mark of 2,436.95)

- $5,000 long Google (Symbol GOOG, marked at 607.83)

That's much better and I'm left with a cash balance of $5,205.48. Essentially I've got a bunch of pairs-type trades, in an attempt to capture value between strong and weak parts of the current insanity. I'm trying to stay relatively neutral in regard to dollar devaluation -- currently I have a slight bias towards further devaluation. My main focus is, as stated previously, capital preservation (independent of Fed action). Hopefully I won't need to do major daily rebalancing, but if things keep whipping around 2 to 5 percent a day, it might be inevitable.

Posted by: Hermit Dave at

12:45 PM

| Comments (2)

| Add Comment

Post contains 335 words, total size 2 kb.

October 18, 2010

I ate shit on the bank short today, mostly due to a lousy entry point near the bottom of the recent range. Â They bounced back strongly into the middle of the range -- good thing I'm not a day trader. Â Everything else was pretty much a wash.

I'm going to add a position in forex:

- $25,000 short EUR / long USD -- current mark of 1.3975

This leaves me with $10,000 cash reserve. Forex is a continuously traded market, so there is no real end-of-day mark on which to base my trades. I'm just marking it to where it is right now.

Posted by: Hermit Dave at

04:52 PM

| No Comments

| Add Comment

Post contains 107 words, total size 1 kb.

October 17, 2010

In the previous post, I say that I'm going to benchmark my trading performance to the S&P 500. Â In the current environment, this is kind of lame, or at least lazy.

The point of benchmarking is to measure one's performance against a standard, so that one's performance can be evaluated. Â If a money manager makes a 10% return in a given year, it might sound great, but if the broad market has gone up 20% at the same time, his performance is actually crap. Â He's effectively lost 10% against the mindless strategy of just buying the broad market.

The key to benchmarking is to select a benchmark that is appropriate to one's goals. Â If you're a stock-picking money manager who is supposed to be fully invested at all times, then the S&P 500 is an appropriate benchmark. Â If your goal is to preserve capital in an uncertain environment, then the S&P 500 is a mediocre benchmark at best.

If the Fed decides to print dollars like mad, then the S&P 500 is a terrible benchmark, because the stock market is bound to go up relative to dollars. Â It reality, the stock market hasn't gone up; the value of the dollar has gone down. Â If the value of one's stock holdings double, but the prices of consumer goods quadruple, then an investor in stocks is screwed -- not as screwed as a holder of cash, but still screwed.

In today's crazy economic environment, the best benchmark is probably a basket of consumable commodities. Â Our goal should be to preserve our purchasing power, which is broadly related to our wealth, which is what we are truly trying to maximize. Â Ideally, I should be benchmarking to a consumption-weighted basket of things like oil, corn, wheat, soybeans, copper, etc. Â This, however, is a pain in the ass (and I'm a lazy bastard), so I'll just leave it for now.

Posted by: Hermit Dave at

11:17 AM

| No Comments

| Add Comment

Post contains 317 words, total size 2 kb.

October 15, 2010

I can hear you out there, all zero of my readers. Â "If you're such an economic whiz, Hermit Dave, why don't you put your fake internet money where your big, obnoxious mouth is?"

OK, even though things are about as uncertain as they can be, and I'd just love to be able to do the financial equivalent of hiding under the bed, I'll bite. Â So, I'm going to start 'trading' and tracking a model portfolio, for the amusement of myself and my zero readers. Â If I do well, I get to gloat. Â If I stink up the joint, nobody will ridicule me, because no one reads my drivel. Â Come to think of it, it's kind of a win-win.

A few simple rules:

- My benchmark will be the Standard and Poors 500 Stock Index. Obviously, I'd like to make money, but in the current environment, capital preservation is the most important thing. So, if the market is down by 50% and I'm only down 10% I still get to gloat. Â

- My thing is macro economics, so don't expect me to pick stocks. I might use a stock (or more likely a sub-index that represents an industry group) to bet on a larger macro-economic concept, but it's generally safe to assume that I know jack shit about company-specific fundamentals.

- I can go short as well as long, with the exception of options. I can only buy, not sell, options.

- I don't get to use leverage. If I'm shorting, it must be for the full notional value of the short. If I'm going long, I can't use margin.

- To keep me from gaming short-term price volatility, all 'trades' will be done at end-of-day prices.

- I can use index values as my 'investments'. In the real world, there are equivalents for all these indexes, whether through futures, ETFs, or direct trading of stock baskets. Using the index value is a convenient shorthand, and has very little effect on real-world returns. Â

- Both transaction costs and taxes will be ignored.

- All positions will be marked at the end of each week, and I'll post the current results. For shorts that have gone against me, I either have to post additional funds (whether from cash reserves or by selling another position) to get back to full notional value, or I have to buy the short back and take the loss.

- I can keep any or all of my money in 'cash'. Cash earns zero interest but has no direct risk. Â

- I start with $100,000 certified fake internet dollars.

That's more than enough rules, I think. Still, one last thing must be said: This is not trading advice. This is a moron jacking off on the internet. Anyone who tries to use any of this crap in the real world deserves to lose all their money and have to eat out of a dumpster for the rest of their short, miserable lives.

My starting position:

- $10,000 long gold (as measured by the COMEX close) -- current mark of $1,371.10 / oz.

- $25,000 short banks (as measured by the KBW Bank Index) -- current mark of 45.24

- $15,000 short NASDAQÂ -- current mark of 2,468.77

- $15,000 long S&P 500 -- current mark of 1,176.19

- $35,000 cash

This is a conservative starting position, as weekend risk is quite high at the moment. The US Dollar seems oversold right now, so a largish cash position is reasonable, plus just holding cash is less risky than making a foreign exchange trade. These bets offset to some extent -- what I'm attempting to do is capture value from where they differ.

This should be entertaining, as my ass is swinging in the breeze for all to see. I hope I don't fuck up too badly.

Posted by: Hermit Dave at

08:54 PM

| No Comments

| Add Comment

Post contains 621 words, total size 4 kb.

October 13, 2010

Best. Financial. Interview. Ever.

(via Zero Hedge)

Posted by: Hermit Dave at

06:03 PM

| No Comments

| Add Comment

Post contains 15 words, total size 1 kb.

April 29, 2009

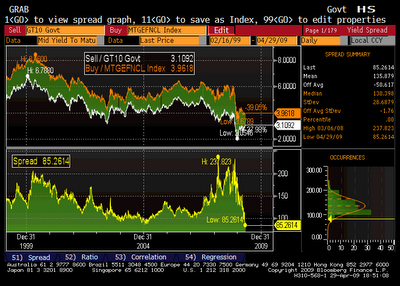

Via Zero Hedge, here is a graph of the spread between Mortgages and the US Treasury 10-year bonds:

Due to the Fed's buying of Mortgage Backed Securities, this spread is now at an all time low. This is completely insane. One of the main reasons we are in this financial mess is because of a complete lack of risk evaluation during the lending process. This chart indicates that, thanks to actions by the Fed, we are now willing to lend more recklessly than ever in an attempt to keep the party going.

Look closely at the progress of the chart. As the economy was turning at the start of the dot.com collapse, the Fed (under Greenspan) flooded the market with cash. A lot of that cash obviously found its way into home mortgages as the spread narrowed quickly from a recessionary 200 bps to just above 100 bps.

Then, during the second half of 2002, the market attempted to return to a more normal state of affairs at around 150bps. However, instead of stabilizing, with the Fed apparrantly unable to get rid of the excess money in the system, the spread quickly collapsed again, bottoming out at under 100 bps in the beginning of 2005. This, of course, aligns quite neatly with the peak of the home-loan insanity, when anyone who could fog a mirror could get a mortgage for pretty much any amount they liked.

Then, as things started to implode, this spread widened out again to around 200bps. Note that if the market had truly overreacted, this spread should have shot up a lot more to compensate lenders for the increased risk of lending in a highly recessionary environment. All the market did was try to price in an appropriate amount of risk, and return to some semblance of sanity in lending standards.

But the financial oligarchy wouldn't have any of that! Instead, the Fed has crushed this spread right back down, to such an extent that, from a credit-risk perspective, we're now even worse off than we were in 2005. Anyone who thinks this could possibly end well is a complete and utter moron. Mortgaging the future, indeed.

Posted by: Hermit Dave at

07:47 PM

| No Comments

| Add Comment

Post contains 366 words, total size 2 kb.

April 09, 2009

On January 16th, the last trading day prior to Obama's inauguration, the market levels were 8281, 844, and 1529 for the Dow, S&P 500, and Nasdaq indicies respectively. Â During the subsequent fall to their March lows, conservative blogs continually pointed at the collapse in these indicies as proof that Obama's financial policies were a disaster.

Today, after rallying for about a month, these same indicies closed at 8083, 857, and 1653. Â Unsurprisingly, the vast majority of conservative blogs have stopped talking about the index levels. Â Using their previous logic, Obama would have to get credit for somehow reversing the course of the markets such that they're now above (on balance, the Dow being the narrowest index) where they were prior to his inauguration.

In fact, if I were a typically idiotic lefty blogger, I'd be trying to give Obama credit for the entire rally, while laying the sell-off at Bush's feet. Â It wouldn't be too hard to make a seemingly good case that the markets sold off due to Obama's honesty in detailing the trouble Bush left us in, but then rallied due to his approach to the situation.

Do I actually believe this? Â Of course not. Â Of course, I didn't believe that Obama's policies had much to do with the sell-off either. Â The only extent to which Obama should get credit in either direction is the initial uncertainty about his policies (Geithner running around like a chicken with his head cut off), followed by some indication of a plan (the quality of the plan is largely immaterial in the short term). Â Markets hate uncertainty, and short of Obama saying he was going to nationalize everything and wipe out the equity holders, they were going to rally on any semblance of organization in the new administration's approach to the financial situation.

The lesson? Â Most bloggers know nothing about markets and should stick to discussion of policy rather than pointing to index levels when they seem to support their positions.

Posted by: Hermit Dave at

04:07 PM

| No Comments

| Add Comment

Post contains 339 words, total size 2 kb.

43 queries taking 0.0606 seconds, 120 records returned.

Powered by Minx 1.1.6c-pink.