May 17, 2009

A) Easier than writing a coherent post on a serious topic

B) Far less depressing than reading the news

C) A bad idea, considering my taste in music

D) All that and a bag of chips

The The, Uncertain Smile:

Posted by: Hermit Dave at

07:38 PM

| No Comments

| Add Comment

Post contains 44 words, total size 1 kb.

May 15, 2009

Continuing the chill out / fiddle while Rome burns idea, here's another great video. Â It's The KLF with a very special (and completely unexpected) guest vocalist, doing a remix from their brilliant album The White Room.

Posted by: Hermit Dave at

10:17 PM

| No Comments

| Add Comment

Post contains 41 words, total size 1 kb.

The economic news today is even more disgusting than yesterday. Â No, I really don't care about the political infighting ... if you want to fiddle while Rome burns, have at it.

All right, I too want to fiddle while Rome burns, but at least I'll be honest about it. Â I've actually been reviewing Youtube vids for the last 6 hours or so, trying to come up with some ideal combination of my favorite music with videos that reflect why I really like that music.

This is way way harder than it sounds.  Anyway, after hours of review, here's Massive Attack, Teardrop:

Posted by: Hermit Dave at

01:50 AM

| No Comments

| Add Comment

Post contains 104 words, total size 1 kb.

May 14, 2009

There's just not enough humor potential to keep this topic going. Â I'm still not smoking, I'm doing reasonably well on reducing my NRT over the 3-month course, and my recovery is painful, but on track.

I may start a new topic (something along the lines of Health and Fitness) about overcoming bad habits and health issues, but this topic is dead in the water. Â If I faill massively and start smoking again, I'll be honest about it, but I sincerely think that I'm finally done with this terrible addiction.

Posted by: Hermit Dave at

12:01 AM

| No Comments

| Add Comment

Post contains 96 words, total size 1 kb.

May 13, 2009

I haven't been posting much over the last few weeks because, aside from slowly recovering from massive nicotine withdrawl, I've been too busy reading all the back history at FMyLife catching up on FEM (Finance, Economics, and Markets). I knew things were really bad, and have said for a while now that Paulson and Bernacke (and Geithner since the Administration change) are completely corrupt, and robbing us blind. Unfortunately, as cynical and pessimistic as I am, it's far worse than I had thought.

Now that I'm up to speed, and not completely delerious from lack of nicotine, I'll hopefully have some thoughts about what one can do financially going forward. In the meantime, please continue to educate yourself, and try to encourage others to do the same. The future of the USA depends on the average voter becoming much more informed on FEM and putting a halt to the partisan politics that is destroying the country.

While I'm organizing my thoughts, have a look at this post at Zero Hedge, and this one at The Market Ticker, for an indication of just how fucked up our government is. Then, watch this video at CSPAN of the most recent AIG hearings. Yes, I know it's almost four hours long. However, this kind of thing is so important, that you should try to make the time, even if it takes watching it in 30 minute stretches over the course of a week.

The choice is clear. We can either continue to look aside while the political/banking kleptocracy loots America until there's nothing left, or we can start taking action. Taking effective action requires knowledge. If you're not willing to turn off the fucking TV and educate yourself, then you're part of the problem, not the solution.

Posted by: Hermit Dave at

09:00 PM

| No Comments

| Add Comment

Post contains 298 words, total size 2 kb.

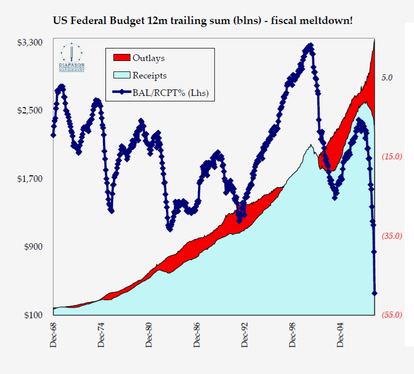

I think this chart speaks for itself, so I'll just be over here in the corner of my cave, whimpering like Obama without a teleprompter. (If you need some explanation, hit the link).

Posted by: Hermit Dave at

06:07 PM

| No Comments

| Add Comment

Post contains 42 words, total size 1 kb.

The Ho Index is a little known (only to me I think) but highly accurate economic indicator. It's the average price charged for one hour of regular services by a hooker in Las Vegas. Unfortunately it's usually a trailing economic indicator as Hos are slow to lower their prices during a downturn, so it's hard to make money as you can't use it as a market timer, and you can't go short Hos.

Anyway, Craigslist has announced that they're getting rid of their erotic services section. While this won't do a damn thing to the overall level of Ho activity, it will make it a lot harder to measure the Ho Index. Don't you State AGs have anything better to do than pressure CL to drop this section? Like, oh I don't know, start prosecuting people for the years of massive fraud in the real estate and financial markets? Useless bastards.

Posted by: Hermit Dave at

05:24 PM

| No Comments

| Add Comment

Post contains 160 words, total size 1 kb.

May 07, 2009

This article in the Independent provides a fascinating and troubling look into Dubai.

I've never been to Dubai, but having been an expat myself at one point, I feel qualified to comment on the typical attitude of wealthy western expats towards the working poor. This article, though extreme, is completely accurate from my experience. I found that the British were always the worst (in terms of their disdain for and abuse of the 'slave class'), followed by the continental Europeans, then the Americans. The Aussies were by far the best.

Dubai will most likely collapse, as it's a testament to the huge (and unsustainable) transfers of wealth from the world's working classes to its elite classes over the past 20 years. The only way in which it might survive is as a safe haven for the international kleptocrats, in the event that they are run out of their own countires due to a populace that is fed up with being robbed.

Posted by: Hermit Dave at

10:18 PM

| Comments (2)

| Add Comment

Post contains 166 words, total size 1 kb.

May 05, 2009

I'm getting better ...

Posted by: Hermit Dave at

09:16 PM

| No Comments

| Add Comment

Post contains 11 words, total size 1 kb.

May 01, 2009

As a follow-up to the prior post, I have a simple question for those who are against allowing mortgage cram-downs during bankruptcy:

Do you approve of TARP, TALF, and the various other backstops that protect the bondholders of insolvent banks at the expense of the taxpayer?

I believe the standard conservative answer would be a resounding "Hell, no."

So, please stop and think for a minute, because these two positions are incompatible. Â We have a huge amount of excess debt in the system, debt that is worth far far less than par based on today's asset prices and ability to service that debt. Â This debt is going to be unwound, one way or another. Â And no matter which way we do it, it won't be pretty.

In my opinion, we must minimize moral hazard, and keep taxpayer expenses to a minimum. Â All the various government programs so far, uinder Paulson and continuing under Geithner, have backstopped the management and bondholders on Wall Street at the expense of the taxpayer. Â I think most conservatives would agree.

How is an opposition to mortgage cram-downs any different? Â Fine, you can force Joe Blow into foreclosure and he'll lose his house, if that makes you feel better. Â However, instead of bothering to file for bankruptcy, he'll just mail in the keys (which is his right under a non-recourse loan), leave no forwarding address and change his phone number to try to dodge the credit-card collection system, and work to rebuild his life from scratch.

Meanwhile, the bank now has the same overpriced asset on their books that they can't write down for fear of their own bankruptcy, and because they're still too big to fail, the next round of government support will simply take more money out of the taxpayer to keep the zombie bank running.

There are plenty of other long-term consequences from this course of action, but I think I've made my point. Â Put aside partisanship and emotion, think through the broader economic consequences, and realize that the source of an idea isn't what's important, it's the idea itself.

One final note: Â Never, ever, ever, ever, ever read the comments to an economic post on a political website. Â You'll be both much dumber and much more aggravated than you would otherwise be, if you had just thought the issue through yourself. Â I've known this for ages, but damn, that seems to be one of those lessons I have to relearn twice a year.

Posted by: Hermit Dave at

07:48 PM

| No Comments

| Add Comment

Post contains 417 words, total size 3 kb.

Yesterday, the Senate defeated an amendment that would have allowed judges to change terms on mortgages during bankruptcy proceedings. This is being touted as a good thing by conservatives, but is it? Let's put aside partisan politics and take a close look at the situation.

The primary conservative argument is that of contract law. Â As Morrissey says at Hot Air:

That is the bigger principle at stake. We are supposed to be a nation of laws, and contract law is supposed to be binding. No one signs a mortgage with a gun at their head. Durbin and his allies want to end the notion that contracts mean what they say. Instead of binding agreements on which people can rely, contracts will become much like the Constitution for the Left — meaning whatever seems expedient from moment to moment.

Removing the political context, I agree with the substance of this. Â In the normal course of business, one must not be allowed to break contracts willy-nilly. Â However, bankruptcy is not the normal course of business. Â Bankruptcy is a very special case, where one's liabilities exceed one's assets, with insufficient cash flow to service debt. Â Personal bankruptcies can be due to bad luck, illness, financial mismanagement, or a host of other things. Â In the case of financial mismanagement, quite often the lender will be complicit in the bankruptcy, through the extension of imprudent credit.

A bankruptcy can be very difficult to sort out, with competing claims by creditors against assets that can be difficult to value. Â This is why we have bankruptcy courts. Â So, let's assume a simple case: Â Joe Blow bought a house for $500,000 by taking out a fixed-rate non-recourse secured loan for $400,000, with a 2nd to finance his down-payment. Â His house is now worth only $300,000, he has no savings, and $20,000 in additional credit card debt. Â The poor guy also lost his job and his dog ran away (just to give it that country music flavor). Â The simple facts of the case: Â He has debts of $520,000 against assets of $300,000 (assuming for simplicity his posessions are worth almost nothing), and no way to service his debt. Â Joe Blow is tapped out and headed for bankruptcy court.

What are the possible outcomes?

- Typically, the court will agree to let the bank foreclose on the house, leaving the bank with a physical asset instead of the $400k loan and a 2nd worth zero. Â The credit card company gets stiffed.

- Alternatively, the court could order a liquidation of the assets and pay creditors according to the seniority of the debt. Â So, the house sells (eventually, maybe) for $300k of which the bank gets everything (the $400k secured loan is primary), the 2nd is written off, and the credit card company of course gets stiffed. Â Given the typical mortgage contract, this will almost never happen.

- Under a cram-down rule, the judge could simply order that the house is now worth $300k and that the bank's $400k loan is now worth $0.75 on the dollar (note that this happens in corporate bankruptcies all the time). Â Now the bank has a decision to make. Â Assuming Joe still has no way to service debt, the end result is going to be the same as (1) above. Â However, perhaps Joe has gotten a new job in the meantime, and it's a job that would allow him to service the debt on a $300k loan, plus make payments against a lowered 2nd and even some payments against a lowered credit-card debt. Â Joe gets to keep his house, his dog comes back, and while he'll need to rebuild his credit rating, this would seem to be the best deal for everyone.

So, from a practical standpoint, we can see that, at worst, the cram-down won't make any difference, and at best might help everyone involved. Â Ahh, but we don't live in a practical world, do we? Â Why are banks so opposed to a cram-down rule for mortgages when the same type of thing happens in corporate bankruptcies all the time?

The answer is simple: Â In case (1) above, the bank has an asset against the original $400k loan, that it can still keep on the books at or near that level. Â Eventually, of course, it will have to dispose of this asset, but it allows the bank to decide when to take the write-down (if needed) or perhaps hold on to the asset in hopes of appreciation (which the bank now gets rather than Joe). Â Of course, the bank has to eat any further losses, but they were on the hook for that regardless.

In cases (2) and (3) above, the bank has to realize a loss immediately, and even though (3) would improve their cash-flow position going forward (and let the credit card company participate), they won't want to take that loss. Â Why? Â Becase the bank is also tapped out and can't afford the hit to capital. Â So, in the interests of continuing the sham of major bank solvency, a less-than-optimal overall economic result occurs.

I understand the emotional desire to punish those who leveraged their lifestyle and took out loans they couldn't afford.  I've been resposible, have zero debt, and am paying for this whole fiasco as much as anyone.  However, I find the arguments against cramdown in bankruptcy to be naieve.  At the end of the day, not allowing for mortgage cram-downs in personal bankruptcy merely prolongs the agony of the big banks, and protects them (and their bondholders) from their bad decisions, against broader societal (taxpayer) interest.

This will probably be the one and only time I agree with Dick Durbin, but the cram-down amendment should have passed.

Posted by: Hermit Dave at

02:02 PM

| No Comments

| Add Comment

Post contains 949 words, total size 6 kb.

45 queries taking 0.0619 seconds, 108 records returned.

Powered by Minx 1.1.6c-pink.