October 20, 2010

While Denninger's latest rant is seriously over the top, I agree with the substance of it to a large extent.

In short, The Tea Party was and is about the the corruption of American Politics and the blatant and outrageous theft from all Americans that has resulted. It is about personal responsibility and enforcement of the law against those who have robbed, financially ****d and pillaged the nation.

Exactly. Get the damn social issues out of the equation, please.

The good news is that the 'official' Tea Party organizations and the self-appointed 'leaders' of the Tea Party will rapidly find themselves out in the cold unless they focus on the truly critical issues facing our nation. If Sarah Palin wants to have any chance of winning the Presidency in 2012 (maybe she does, maybe not, who knows at this point), she better start boning up on economics.

Tea partiers aren't committed to any specific organization and they aren't dedicated to any particular leader. Any semblance of formal organization is short-term and focused on trying to give us better candidate choices in specific races. Any organization or leader who thinks they have permanent support is going to be extremely surprised when they find out they have zero support if they don't focus on what really ails us as a nation (I'm looking at you Scott Brown -- later dude -- you served your purpose, now take a hike).

But again, this is the beauty of an energized electorate. The 'throw the bums out' movement is here to stay, regardless of anyone who might try to co-opt it for their own purposes. Fuck the Tea Party. Long live tea partiers.

Posted by: Hermit Dave at

10:20 AM

| No Comments

| Add Comment

Post contains 285 words, total size 2 kb.

October 19, 2010

One of the best ways to help force accountability on the big banks, the Fed, and eventually the US Government, is by removing their access to your savings. One way to do this is to keep your savings in precious metals and other items of value instead of dollars. This, however, is both impractical and risky, if done with one's entire savings.

A much simpler and still highly effective course of action is to move all your accounts from the big banks to local banks (or credit unions). If enough people did this, the big banks would all fail, and the Fed wouldn't be able to do a damn thing about it. A commercial bank without a base of deposits simply can not exist.

Whether or not you do any business with the big banks, I strongly suggest you have a look at Move your Money. This site is a wonderful, easy-to-use resource for finding sound community banks in one's area. Even if you're already with a local bank, you can use it to check on the fiscal health of that bank, and find out whether you might want to move your money elsewhere.

I don't have any money with the big banks. Do you?

Posted by: Hermit Dave at

07:33 PM

| No Comments

| Add Comment

Post contains 208 words, total size 1 kb.

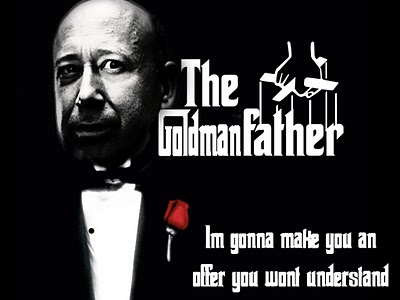

I rarely laugh out loud, but I did at this:

Unless you're familiar with high finance you probably won't get it, or even know who the guy is, but it's funny on a number of levels. Trust me. Really.

(credit to williambanzai7 in the comments at ZH)

Posted by: Hermit Dave at

03:38 PM

| No Comments

| Add Comment

Post contains 49 words, total size 1 kb.

I picked a bad week to start sniffing glue. Things are all over the freaking map, thanks to the Fed dicking with dollar devaluation. Almost everything is trading strictly based on various views of whether and how much the Fed will continue to devalue the dollar. Fundamentals? Common sense? Bankrupt companies being forced to tell the truth about their balance sheet and actually go under? I wish.

One thing about my portfolio is clear -- it's way too concentrated in certain places, so I need to rebalance and diversify. To that end:

- Closing the short bank position at a mark of 46.03, a loss of $429.07

- Closing the NASDAQ short at a mark of 2,436.95, a gain of $195.86

- Closing the short EUR / long USD position at a mark of 1.3734, a gain of $438.69

This leaves me with my long gold and long S&P 500 positions, and a cash balance of $75,205.48. I don't want to have a zillion positions, but I need to spread the risk out a bit. New and re-established positions:

- $20,000 short banks (KBW bank index mark of 46.03)

- $5,000 long Goldman Sachs (Symbol GS, marked at 156.72)

- $5,000 long JP Morgan Chase (Symbol JPM, marked at 37.69)

- $10,000 long oil (Nymex front month mark of $79.52)

- $15,000 short EUR / long USD (mark of 1.3734)

- $10,000 short NASDAQ (mark of 2,436.95)

- $5,000 long Google (Symbol GOOG, marked at 607.83)

That's much better and I'm left with a cash balance of $5,205.48. Essentially I've got a bunch of pairs-type trades, in an attempt to capture value between strong and weak parts of the current insanity. I'm trying to stay relatively neutral in regard to dollar devaluation -- currently I have a slight bias towards further devaluation. My main focus is, as stated previously, capital preservation (independent of Fed action). Hopefully I won't need to do major daily rebalancing, but if things keep whipping around 2 to 5 percent a day, it might be inevitable.

Posted by: Hermit Dave at

12:45 PM

| Comments (2)

| Add Comment

Post contains 335 words, total size 2 kb.

October 18, 2010

I ate shit on the bank short today, mostly due to a lousy entry point near the bottom of the recent range. Â They bounced back strongly into the middle of the range -- good thing I'm not a day trader. Â Everything else was pretty much a wash.

I'm going to add a position in forex:

- $25,000 short EUR / long USD -- current mark of 1.3975

This leaves me with $10,000 cash reserve. Forex is a continuously traded market, so there is no real end-of-day mark on which to base my trades. I'm just marking it to where it is right now.

Posted by: Hermit Dave at

04:52 PM

| No Comments

| Add Comment

Post contains 107 words, total size 1 kb.

Perusing the web, I've come across a lot of complaining about the choice for CA Governor. A lot of people who sat out Obama / McCain (as I did) are threatening to sit this one out too. Although I agree she's not a wonderful candidate, I still think one should vote for Whitman.

If we're going to throw the bums out, we have to give newcomers a chance, even if they seem less than ideal. Whitman is all over the place on her campaign statements, but I give little weight to the words of politicians. I look at their prior history. With a newcomer, you simply don't have that prior history.

As a GOP-leaning independent, I wanted a new choice for Governer. I got that -- I may not love the exact person the GOP picked, but I have to acknowledge that I got an outsider. I'm not going to be a libertarian douchebag and whine that Whitman's not exactly what I wanted. I'm going to vote for her and hope for the best. If she sucks (and she probably will), I'll be looking to throw her out on her ass the next time around, but she at least deserves a chance.

Contrast this to Obama / McCain. McCain is a known political shithead. He has a long history of being a shithead. I had very good reasons to sit that election out (and no I'm not looking to go into it all again). If I want my vote to be considered at all, however, I must be willing to compromise and vote for the GOP candidate when I get enough of what I ask for.

I get it. Meg Whitman is a mush-brained dodohead who is likely to just try to muddle through the current fiscal disaster. But she's a new mush-brained dodohead who might actually accomplish something if given a chance. I still intend to vote for her.

Posted by: Hermit Dave at

11:28 AM

| No Comments

| Add Comment

Post contains 324 words, total size 2 kb.

I'm just about through with calling myself a libertarian. I've tried putting various descriptors on the term: 'small-l libertarian', 'conservative libertarian', 'non-doctrinaire libertarian', 'practical libertarian', etc., but they neither satisfy nor roll off the tongue nicely. I'm at the point where I have no idea what to call my ideological bent.

Melissa Clouthier has written a very good piece about how libertarians have completely marginalized themselves. I'm having difficulty finding a short part to excerpt, so RTWT. It's not very long. The point of the article is that, in a year when the Tea Party has had a huge impact, and there is a real choice to be made at the polls in many races, the libertarians are still whining and refusing to vote.

Now, I'm a firm believer in not voting for the lesser of two evils, but one can take this much too far. One must have some sense of priorities and not let 'the perfect be the enemy of the good'. I hate that fucking phrase as it's used all the time by people as a way to say, "sure we suck, but we're slightly less sucky, so vote for us," but in this case it's appropriate. The key is that you need some good, which is why I'm willing to sit out if needed, but you don't need all good, or you'll never vote. To recognize 'some good', you have to have priorities.

And that's the big problem with libertarians. Their priorities are completely fucked up. They deserve the mocking they get as a bunch of stoners, because legalizing pot should be a very low priority item, given everything else that's going on in the country. In theory, I'm all for legalizing pot, but relative to getting entitlements and government pensions under control, the war on drugs is a fucking drop in the bucket. If that's your hill to die on, your issue that you're willing to sit out for (or worse, cast a vote for a socialist), you're a fucking asshole.

This is why Ron Paul is such a joke. He's got all kinds of shady associations. He's out there talking about a return to the gold standard, when to even get to the point where it could be considered, a zillion other more important things would have to happen first. Priorities, asshole. Then, when he proposes important, practical legislation like an audit of the Fed, he has trouble getting taken seriously because he's out there in la-la-libertarian-land so often.

Maybe I should continue to call myself a libertarian, and just call fucktards like Matt Welch something else -- like fucktard. The problem is that they and others will continue to call them libertarians. So, I'm kind of stuck at the moment. I'll just have to keep myself on a practical, prioritized course of action while I come up with a new ideological term.

Posted by: Hermit Dave at

07:51 AM

| No Comments

| Add Comment

Post contains 485 words, total size 3 kb.

October 17, 2010

Posted by: Hermit Dave at

11:46 AM

| No Comments

| Add Comment

Post contains 23 words, total size 1 kb.

In the previous post, I say that I'm going to benchmark my trading performance to the S&P 500. Â In the current environment, this is kind of lame, or at least lazy.

The point of benchmarking is to measure one's performance against a standard, so that one's performance can be evaluated. Â If a money manager makes a 10% return in a given year, it might sound great, but if the broad market has gone up 20% at the same time, his performance is actually crap. Â He's effectively lost 10% against the mindless strategy of just buying the broad market.

The key to benchmarking is to select a benchmark that is appropriate to one's goals. Â If you're a stock-picking money manager who is supposed to be fully invested at all times, then the S&P 500 is an appropriate benchmark. Â If your goal is to preserve capital in an uncertain environment, then the S&P 500 is a mediocre benchmark at best.

If the Fed decides to print dollars like mad, then the S&P 500 is a terrible benchmark, because the stock market is bound to go up relative to dollars. Â It reality, the stock market hasn't gone up; the value of the dollar has gone down. Â If the value of one's stock holdings double, but the prices of consumer goods quadruple, then an investor in stocks is screwed -- not as screwed as a holder of cash, but still screwed.

In today's crazy economic environment, the best benchmark is probably a basket of consumable commodities. Â Our goal should be to preserve our purchasing power, which is broadly related to our wealth, which is what we are truly trying to maximize. Â Ideally, I should be benchmarking to a consumption-weighted basket of things like oil, corn, wheat, soybeans, copper, etc. Â This, however, is a pain in the ass (and I'm a lazy bastard), so I'll just leave it for now.

Posted by: Hermit Dave at

11:17 AM

| No Comments

| Add Comment

Post contains 317 words, total size 2 kb.

October 15, 2010

I can hear you out there, all zero of my readers. Â "If you're such an economic whiz, Hermit Dave, why don't you put your fake internet money where your big, obnoxious mouth is?"

OK, even though things are about as uncertain as they can be, and I'd just love to be able to do the financial equivalent of hiding under the bed, I'll bite. Â So, I'm going to start 'trading' and tracking a model portfolio, for the amusement of myself and my zero readers. Â If I do well, I get to gloat. Â If I stink up the joint, nobody will ridicule me, because no one reads my drivel. Â Come to think of it, it's kind of a win-win.

A few simple rules:

- My benchmark will be the Standard and Poors 500 Stock Index. Obviously, I'd like to make money, but in the current environment, capital preservation is the most important thing. So, if the market is down by 50% and I'm only down 10% I still get to gloat. Â

- My thing is macro economics, so don't expect me to pick stocks. I might use a stock (or more likely a sub-index that represents an industry group) to bet on a larger macro-economic concept, but it's generally safe to assume that I know jack shit about company-specific fundamentals.

- I can go short as well as long, with the exception of options. I can only buy, not sell, options.

- I don't get to use leverage. If I'm shorting, it must be for the full notional value of the short. If I'm going long, I can't use margin.

- To keep me from gaming short-term price volatility, all 'trades' will be done at end-of-day prices.

- I can use index values as my 'investments'. In the real world, there are equivalents for all these indexes, whether through futures, ETFs, or direct trading of stock baskets. Using the index value is a convenient shorthand, and has very little effect on real-world returns. Â

- Both transaction costs and taxes will be ignored.

- All positions will be marked at the end of each week, and I'll post the current results. For shorts that have gone against me, I either have to post additional funds (whether from cash reserves or by selling another position) to get back to full notional value, or I have to buy the short back and take the loss.

- I can keep any or all of my money in 'cash'. Cash earns zero interest but has no direct risk. Â

- I start with $100,000 certified fake internet dollars.

That's more than enough rules, I think. Still, one last thing must be said: This is not trading advice. This is a moron jacking off on the internet. Anyone who tries to use any of this crap in the real world deserves to lose all their money and have to eat out of a dumpster for the rest of their short, miserable lives.

My starting position:

- $10,000 long gold (as measured by the COMEX close) -- current mark of $1,371.10 / oz.

- $25,000 short banks (as measured by the KBW Bank Index) -- current mark of 45.24

- $15,000 short NASDAQÂ -- current mark of 2,468.77

- $15,000 long S&P 500 -- current mark of 1,176.19

- $35,000 cash

This is a conservative starting position, as weekend risk is quite high at the moment. The US Dollar seems oversold right now, so a largish cash position is reasonable, plus just holding cash is less risky than making a foreign exchange trade. These bets offset to some extent -- what I'm attempting to do is capture value from where they differ.

This should be entertaining, as my ass is swinging in the breeze for all to see. I hope I don't fuck up too badly.

Posted by: Hermit Dave at

08:54 PM

| No Comments

| Add Comment

Post contains 621 words, total size 4 kb.

Iowahawk is well-known as one of the best humorists on the right, which makes him one of the best humorists in politics, as everyone knows the left has no sense of humor whatsoever.

As with any great humorist, his work is uneven, from screamingly funny and on-point to meh. Â His latest piece, using an old-school text computer game to satirize Obama's time as President, is one of the single best things he's ever written.

Why are you here? Go read it before it's linked by every single right-leaning blog in existence (which it will be).

Posted by: Hermit Dave at

01:06 PM

| No Comments

| Add Comment

Post contains 99 words, total size 1 kb.

I just realized that I didn't include guns (or other weapons) anywhere in the previous post. This is a serious oversight, as gun valuation and gold valuation are linked in many ways, yet ultimately completely uncorrelated.

Gun valuation is extremely interesting. In a perfectly stable society, they're only worth whatever recreational value people might place on them. This is similar to gold: in a society with a stable fiat currency, gold only has industrial and ornamentation value.

In a more realistic society, guns have the additional value of self-defense. This won't increase the worth of guns much, as crime is relatively low and military needs are limited, but it adds some value. This added value is extremely important however, as when one needs a gun, one is likely to really really need a gun. Again, this is similar to gold, in that it's a form of insurance. Just as I believe one should always have some gold, one should also have some guns.

As we get further away from a stable society, however, guns become increasingly more important. The value of gold will spike into a fiat devaluation event, but at the far margin (the Mad Max / Zombie Apocalypse scenario) it becomes completely worthless. A gun, however, is at its highest value on the far margin.

The gold to gun valuation relationship is at a very odd point right now. Essentially, the current valuations are telling us that, while a fiat currency breakdown is increasingly likely, a major societal disruption is still highly unlikely. I think these events are much more correlated than the market is currently assuming. On a relative basis, guns are unbelievably inexpensive. Go buy one.

Addendum: Veeshir's comment made me think a bit more. The rise in gun prices may be slowing down if the market for them is becoming saturated. One can't use more than a few at a time. Therefore ammo is really the factor to consider when looking at the pricing of gold vs. weapons. As Veeshir notes, ammo prices have gone up a lot more than gun prices in the last few years. I don't know if the relationship is at a sensible level though, as it's hard to find historical data on ammo prices.

Posted by: Hermit Dave at

11:31 AM

| Comments (2)

| Add Comment

Post contains 378 words, total size 2 kb.

Gold is a subject of much contention in the financial world. Â There are the 'gold bugs' who worship the stuff; there are haters, who think it's nearly worthless; there are those who view it as just another commodity; and, of course, there are those who think we should go back to a 'gold standard' for the US Dollar. Â How should a rational person view gold?

First, contrary to much of what one hears as common wisdom, gold is not a good inflation hedge. Yes, it can act as an inflation hedge at times, but it is extremely unreliable in this regard. Real estate is a much better hedge against broad-based, moderate inflation.

What gold is best for, and the reason why it is soaring at this time, is as a potential alternative currency. With the Fed trashing the US Dollar on an ongoing basis, and with the market assuming that they will continue to do so in an ever-increasing fashion, one must look for a different store of value for one's savings.  While large-scale dollar devaluation is wonderful for eliminating old debts, it destroys the value of all capital that is denominated in US Dollars. Hence, producers and savers must look for a way to retain the value of their holdings.

There are many potential assets into which one can convert his increasingly-worthless dollars, but there are issues with most of them: illiquidity (real estate), spoilage (food), valuation difficulties (diamonds), potential devaluation (other fiat currencies), etc. What is needed is an alternative currency, something which can maintain its value and is at the same time easily tradable. Gold and other precious metals work very well in this regard.

To see why gold, as opposed to other assets, can be a successful currency, let's examine the characteristics of a currency. A currency must be:

-

Durable -- it must not degrade over time.

-

Non-consumable -- even if used for other purposes, it must be recoverable

-

Relatively rare -- it can't be something so common as to be worthless

-

Relatively common -- there must be enough of it to circulate

-

Difficult to produce -- it can't be something everyone can get or make in quantity

-

Easy to verify -- counterfeiting must be avoided

-

Easy to value -- it must be completely consistent and measurable

-

Agreed upon -- most people must be willing to accept it as a means of trade

Gold passes all these tests. So does silver. One doesn't hear about 'silver bugs' simply because silver is more common than gold, but it would make an excellent smaller-denomination currency.

If one looks at the history of gold pricing (especially the period since restrictions on valuation and private ownership were lifted in the 1970s), gold has risen when the value of the US Dollar was in doubt. When people had faith in the US Dollar as a store of value, gold drifted lower towards its base industrial and jewelry value. Today, gold is soaring as the value of the US Dollar (and other fiat currencies) is being questioned more strongly than ever.

What should today's saver / investor do about gold? That largely depends on how one believes the Fed will act. If one believes the Fed will continue to destroy the value of the dollar, one should buy gold and other good alternative stores of value. If one believes the the Fed will get its act together and stop the current insanity, it would be a terrible time to buy gold.

I believe that one should always have some gold, for the simple reason that a central bank (or treasury -- whatever government function controls the currency) can always decide to devalue a fiat currency. However, I also believe in diversification. To the extent one can afford them and/or has space to store them, one's 'portfolio' should include real estate, silver, hand tools, a generator, food, fuel, a high-quality water filter, whiskey, etc. Essentially, one should have things that hold value, are tradable, and/or are used to produce trade and survival goods.

Best of luck to all in these uncertain times.

Posted by: Hermit Dave at

09:25 AM

| Comments (2)

| Add Comment

Post contains 677 words, total size 5 kb.

October 14, 2010

Today's project: Â paint a bathroom. Â Fuck, talk about tedious. Â At least with a bedroom you can clear out all the furniture, remove or tape any fixtures (outlet covers, etc.) and get the sprayer out. Â A bathroom is all edgework -- around the toilet, the countertop, the shower stall. Â Fuck me.

Posted by: Hermit Dave at

02:12 PM

| No Comments

| Add Comment

Post contains 53 words, total size 1 kb.

October 13, 2010

Best. Financial. Interview. Ever.

(via Zero Hedge)

Posted by: Hermit Dave at

06:03 PM

| No Comments

| Add Comment

Post contains 15 words, total size 1 kb.

It's time to evaluate my choices and make my decisions about the coming elections. Â Being in inland Southern California, my primary choices will be in my local House race (Issa / Who Cares), Governor (Whitman / Moonbeam), and US Senator (Fiorina / Ma'am). Â In theory, I'm perfectly willing to vote for either party; in practice, in California, voting for a Dem is the same as showering in hydrochloric acid -- incredibly painful, disfiguring, and ultimately fatal.

I refuse to vote for the lesser of two evils, so my choice is either to vote for the GOP candidate or sit it out / cast a protest vote.  I would only consider both candidates if they were both good candidates and I had to make a decision about which was better.  As 'good candidate' and 'California Democrat' are mutually incompatible terms, I'll simply evaluate each GOP candidate on their own merits and decide whether they're worth a vote or not.

The House race: Â It's always good to be able to get off to an easy start. Â Issa is one of the single best House members. Â I'd like to see him be even more focused on fiscal issues, have more of a public presence, and bring out the big guns on some major bad actors. Â He's on the right path for this, and I have high hopes for his long-term prospects. Â Returning Issa to the House is as easy a decision as anyone can ever have in politics.

The race for Governor: Â Whitman is about as exciting as a bowl of oatmeal. Â The state of California's finances is so bad, however, that her range of potential action is going to be extremely limited. Â To her credit, she's attempting to get out in front of certain issues such as public service pensions, and I think she'll be reasonably proactive in trying to deal with fiscal matters. Â I'm not thrilled, but I think she's good enough to get my vote.

The Senate race: Â Fiorina is an enigma. Â Her tenure at HP was stormy, to say the least, and there are as many opinions on her performance as there are opinionators. Â Unlike many, I'm not going to fault her for HP's stock price performance, as her tenure coincided with the collapse of the tech bubble. Â She has real fiscal chops; the question is whether she will use them for good (reform) or evil (obfuscation / status quo). Â She has the potential to be a brilliant Senator. Â She could also be a flop of epic proportions. Â Being GOP, she'll be thrown out on her ass in 6 years unless she is brilliant, so I'm going to vote for her and hope for the best.

So there you have it -- GOP votes across the board. Â Note that I'm giving no consideration whatsoever to social issues. Â This is because I don't give two shits about them. Â On the margins, as a libertarian, I'd go for someone who is socially liberal, but at this time social issues are completely dwarfed by fiscal ones. Â As none of these candidates have any draconian social positions, my evaluation of them is based strictly on their likely fiscal performance.

I think I'll be 3/3 this year, but it's possible I could be 1/3. Â Issa is a sure thing. Â Is anyone even running against him? Â I didn't bother checking, as I'd vote for Issa over the ghost of Hayek -- that's just how much I like the guy.

Posted by: Hermit Dave at

12:55 PM

| No Comments

| Add Comment

Post contains 579 words, total size 3 kb.

October 12, 2010

I have a dream of a situation that highlights just how fucked up the US Senate is. Â A situation that shows that almost every single sitting Senator is hopelessly corrupt. Â A situation in which each vote is important and Senators find it nearly impossible to hide their back-door dealings. Â A situation which also forces the administration to get involved and fully reveal the bankrupt policies of Obama. Â A situation of such utter gridlock that legislation, except that which is truly popular and needed, would have no chance of passing.

I have a dream of a 50-50 Senate.

If the House is a circus, the Senate is the sewer below the circus into which all the elephant shit and other waste drains. Â The only sitting Senator for which I have any admiration is DeMint. Â A 50-50 Senate would give him a much bigger platform from which to spread his reformist policies.

A 50-50 Senate would force Joe 'the village idiot' Biden into the spotlight as a possible tiebreaker. Â Biden, the clueless dipshit that he is, would bask in the spotlight and do irreparable harm to the Obama administration.

The GOP would prefer to flip the Senate. Â I say that this would do far more harm than good, especially in consideration of the 2012 elections. Â A 50-50 split would be much more likely to drain the sewer that is the US Senate, keeping the pressure on individual Senators, rather than on the GOP as a whole.

A 50-50 Senate is a very real possibility this year. Â I have a dream.

Posted by: Hermit Dave at

02:05 PM

| No Comments

| Add Comment

Post contains 262 words, total size 2 kb.

In order to try to break up the beltway gang that's selling this country down the river, more people seem to be in favor of term limits these days. Yet I, a huge supporter of 'throw the bums out', think the idea is completely idiotic. Why?

First, it's lazy -- a direct deriliction of our duty as voters. If we're willing to throw the bums out, we don't need term limits.

Second, and much more importantly, you get the worst of both worlds. People who are good public servants get termed out, while those who are willing to whore themselves out have no reason not to. If a dishonest pol is going to be out, no matter what, after a fixed time, he's going to be completely unrestrained in selling himself.

Lastly, term limits ignore one of the biggest problems in government -- the entrenched bureaucracy. A good pol that gets termed out has no real chance to cut the huge fat in government. The bureaucracy can just wait him out, something they're experts at.

Term limits remove incentives for good politicians while doing little to nothing to restrain the bad ones. They're a terrible idea.

Posted by: Hermit Dave at

12:21 PM

| No Comments

| Add Comment

Post contains 200 words, total size 1 kb.

October 11, 2010

It turns out that Paladino never actually said the specific remarks that started the whole firestorm over at DPUD. So, by attempting to frame the debate dishonestly, IVD has just made himself look like a complete and utter tool.

This whole fiasco is a perfect example of why one should frame their points honestly. Then, when new information comes to light, you can still have a valid argument, rather than a smoking crater where your credibility used to be.

Even though Paladino didn't say those specific words, the facts remain that: (1) He was reading the prepared comments of a third party, and in such a way that they could be misconstrued as his own comments, and (2) He's discussing a very divisive social issue in an election where one should be able to run solely on fiscal issues. Both of these show extremely bad judgment, at the very least.

If you can't win this year when running against a long-term political insider by focusing on just fiscal issues, you weren't going to win under any circumstances. Whether or not Paladino is homophobic may be back up in the air, but there's no doubt he's a dipshit and a lousy candidate, which brings us right back to the issue of candidate vetting.

If this debate had been framed honestly from the start, this revelation about what Paladino actually said wouldn't make a bit of difference.

Posted by: Hermit Dave at

06:08 PM

| No Comments

| Add Comment

Post contains 236 words, total size 1 kb.

How to get people to pay attention to airline safety instructions:

(via Hawtness)

Posted by: Hermit Dave at

10:16 AM

| No Comments

| Add Comment

Post contains 16 words, total size 1 kb.

47 queries taking 0.1244 seconds, 130 records returned.

Powered by Minx 1.1.6c-pink.