December 09, 2010

Posted by: Hermit Dave at

06:49 PM

| No Comments

| Add Comment

Post contains 33 words, total size 1 kb.

If you want an excellent (if a bit hyperbolic) summary of what was revealed by the Fed's recent forced document dump, read this. Strong proof that, until the government deals with the Fed, your votes mean absolutely nothing.

(via Black Listed News)

Posted by: Hermit Dave at

12:25 PM

| No Comments

| Add Comment

Post contains 47 words, total size 1 kb.

If there's one thing better than being right, it's being right and early enough to capture the entire move in an asset. As far as silver and gold go, there's one person that outshines everyone in regard to their affection for precious metals. That person, of course, is Yukon Cornelius:

Posted by: Hermit Dave at

10:00 AM

| No Comments

| Add Comment

Post contains 53 words, total size 1 kb.

December 08, 2010

Bonds almost always lead stocks for the simple reason that it's a much, much bigger market and a hell of a lot harder to play games with. Stock traders are complete pikers compared to the bond boys. So, it's somewhat unsettling to see bond yields rise fairly dramatically since the start of QE2.Â

For example, the 10-year rate (arguably the most important point on the yield curve, as it's the most closely tied to mortgage rates, among other reasons) has increased almost 0.75%, going from about 2.5% to about 3.25%. The iShares Barclays 7-10 Year Treasury Fund (ticker IEF) is down almost exactly 5% since the start of QE2 (bond prices move inversely to yields). This is extremely bad news for housing prices and will eventually put heavy pressure on stocks.

There are other factors at play that might give us pause when it comes to asset prices. The Fed's current attempt to generate inflation might fail, or they might be forced to change their policies. Other nations could get completely sick of our approach to our predicament and start dumping assets wholesale (the Chinese have started tightening their monetary policy). Some EU nations could try to stop the insanity and start letting countries and banks go under (Germany is starting to make serious noises about being sick and tired of trying to bail everyone out). Hell, the EU itself could break up quite easily.

All this brings us back to the question of whether we should be in cash or holding a wealth preservation portfolio. This is a hell of a difficult choice to make, but could be crucial to our long-term fiscal health. Or can we have our cake and eat it too? To a certain extent we can, by hedging our wealth preservation portfolio by going short the US stock market.

The way to do this would be to either sell futures or buy puts on a major stock market index. The S&P 500 is probably the best index to use as a hedge. For futures, one would sell an amount that would insure the notional value of one's wealth preservation portfolio. Now, instead of just holding an outright position in risk assets, one would be effectively holding the spread between a wealth preservation portfolio and an investment portfolio. There's a lot less total risk in this position, but most likely less upside as well. It's also an expensive strategy to implement as one has to divide his funds evenly between the long and short positions.

A much less expensive strategy (in terms of up-front cash) to implement is to buy puts. A put is one of the two types of options (the other being the call), and gives one the right (but not the obligation) to sell an asset at a specific price at a future date. For example, one could own the March 2011 1050 puts on the S&P 500. This would allow one to sell the index at 1050 (about 15% below the current market level) at the option expiry date in March. This gives us protection against a major asset crash, while committing less than 10% of our total funds to doing so. Of course, this strategy comes with a different price: time decay. Even if the market goes nowhere, one would lose the premium paid to insure his portfolio. In the worst case (a completely flat market), this would cost us about 5-8% a year.

So, there are no completely free lunches -- hardly surprising.   The only way in which one gets burned by this type of hedging strategy is if we have a low-inflation economic recovery. In that case, an investment fund would outperform a wealth preservation fund, causing us to lose on both sides of our positions (obviously I think this is just a tad unlikely, to say the least). On the other hand, we could have a high-inflation economic collapse, giving us a win on both sides. Most likely, we'll capture some outperformance by hedging, while significantly reducing our risk. For those with significant assets to protect, insuring at least part of one's portfolio against an asset crash is, in my opinion, a very good idea.

Posted by: Hermit Dave at

05:21 PM

| No Comments

| Add Comment

Post contains 703 words, total size 4 kb.

December 06, 2010

How high is silver going? Well, based on the silver/gold ratio alone, one can make a case for silver at $80 - $100 per ounce. Also, as gold becomes increasingly unaffordable as jewelry for most people, a silver substitute would imply a continued rally.

I'm not much for price targets -- fundamental factors can change rapidly and Mr. Market will be the final determining factor in any event. I simply note that, even though silver seems to be quite high at this price, one can make a case for it going much, much higher.

Posted by: Hermit Dave at

12:41 PM

| No Comments

| Add Comment

Post contains 99 words, total size 1 kb.

December 03, 2010

Posted by: Hermit Dave at

08:20 PM

| No Comments

| Add Comment

Post contains 25 words, total size 1 kb.

The markets went from hanging by a thread on Tuesday to another huge reversal as the dollar stopped strengthening. Currencies are now trading completely backwards -- the tail is firmly wagging the dog. The Dollar rallied against the Euro as the situation in Europe further deteriorated, and then the ECB dramatically increased its pace of monetization. In a remotely normal world, this would have further killed the Euro, but instead it immediately caused the Dollar to start selling back off. Why? Because of increased pressure on the Fed to step up their pace of monetization. Bizarre, but that's the world in which we're living.

Current status of our fund battle:

| Asset | Start | Current | Change |

| Gold | 1348.59 | 1413.43 | 4.81% |

| Silver | 24.80 | 29.24 | 17.90% |

| DBC | 25.69 | 26.36 | 2.61% |

| Dow | 11215.13 | 11382.09 | 1.49% |

| Nasdaq | 2540.27 | 2591.46 | 2.02% |

| S&P 500 | 1197.96 | 1224.71 | 2.23% |

| Wealth Fund | $12,000 | $12,837.82 | 6.98% |

| Investment Fund | $12,000 | $12,229.47 | 1.91% |

The Wealth Fund completely took off vs. the Investment Fund and is now ahead by slightly over 5%. There's every reason to believe that this trend will continue as long as the governments of the world continue to monetize all the bad debt. Bank and Government debt will be defaulted on, one way or another. A hard default is unacceptable to most, so we're starting to get a soft default -- inflating the debt away. As I've stated many times previously, one does not want to be invested in the markets in this environment. They'll most likely go up, but at a pace well below the rate of inflation. I'll stick with a wealth preservation strategy, thank you.

No changes to the Ben Bernanke betting game, even though the recent data dump by the Fed indicates that Bernanke both made illegal trades and perjured himself in various testimonies. In a sane world, the man would already be swinging from a lamp post or at least wearing an orange jumpsuit -- in this world, nobody cares with the exception of a handful of financial bloggers. The Fed and the banks are holding the American people at fiscal gunpoint and nobody has the courage or political will do to anything about it. So be it.

Current odds for Bernanke's fate as of the end of next year:

- Strangled by Ron Paul -- 1000 to 1

- Hung for Treason -- 100 to 1

- Commits Suicide -- 75 to 1

- Killed by bankrupt lunatic -- 50 to 1

- Dead by other means / natural causes -- 35 to 1

- Fled the country -- 25 to 1

- Under indictment (or already jailed) -- 10 to 1

- Forced out of the Fed but free -- 3 to 2

- Still selling America down the river -- 3 to 2

Have a good weekend. Got silver?

Posted by: Hermit Dave at

02:56 PM

| No Comments

| Add Comment

Post contains 462 words, total size 5 kb.

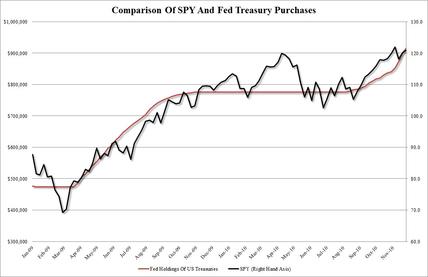

If you think that the stock market rally in the face of declining economic fundamentals seems a tad suspicious, you're not alone. Well, Zero Hedge has a single, simple graph that explains everything:

There's just a small correlation between Fed monetization and the rally in stocks, now isn't there?

Posted by: Hermit Dave at

10:46 AM

| No Comments

| Add Comment

Post contains 59 words, total size 1 kb.

43 queries taking 0.0618 seconds, 99 records returned.

Powered by Minx 1.1.6c-pink.